Investors underestimate Euro-zone strength

While Brexit and the US/China trade war have caused strong negative sentiment, investors may be underestimating the strength of domestic demand growth in the Euro-zone, according to Neuberger Berman.

The firm’s head of European fixed income, Patrick Barbe, said the Euro-zone had faced a lot of economic, regulatory and political uncertainties and challenges, causing euro-zone economic activity to be relatively weak.

Despite this, Barbe said the reality of the current picture of the Euro-zone was much more complex than the one painted by poor market confidence and leading indicators like the one per cent inflation rate.

Domestic activity in the Euro-zone was holding up well, with household confidence remaining high, and while pessimism has been reinforced by political risks, the Brexit delay should boost activity for the next few months.

“Indeed, as it appears more and more likely that a fragmented UK parliament will fail to reach agreement, many corporations may choose to transfer a part of their production capacity out of the UK and into the euro zone, which would be supportive of the euro-zone economy,” he said.

And while the other major political issue, the global trade war, had knock-off effects on the Euro-zone, Barbe didn’t expect it to impact global giants like Germany too much.

“It is not hard to imagine weakness in German manufacturing spreading through the euro zone, given that Germany represents one-third of the region’s output,” he said.

“Still, we do not believe one of the best industries in the world, whose business models are based on high-quality technology and services, is likely to be severely destabilized by these disputes.”

Given this, Barbe said investors were underestimating the strength of domestic demand growth that was being supported by the European Central Bank policy, stronger banks and the cheap ero.

“Investors also appear to undervalue the ability to respond to recent difficulties that euro-zone industry has demonstrated,” he said.

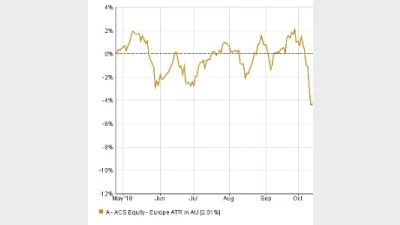

The chart below tracks the performance of the European equities sector for the 12 months to 26 April.

Recommended for you

The use of total portfolio approaches by asset allocators is putting pressure on fund managers with outperformance being “no longer sufficient” when it comes to fund development.

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.

Schroders has appointed a fund manager to its $6.9 billion fixed income team who joins from Macquarie Asset Management.