India set to be third-largest economy by 2030

India is set to become the world’s third-largest economy by 2030 as the country moves from being a ‘fringe player’ to a global powerhouse, according to Fiducian.

The country was currently the fifth-largest in the world, up from 11th, driven by factors such as the Modi government, increased direct foreign capital investment and tax cuts. Fiducian said it expected this could rise to third-largest by 2030 which would place the country behind only the US and China.

Foreign direct capital investment into manufacturing and service had risen to around US $50 billion a year. Corporate earnings growth is expected to be 24.5% in 2019 and 20% in 2020 which would put India ahead of other significant economies.

While there had been large withdrawals by foreign investors over the last 10-15 years, investors were now returning and Indian investors were also increasing their own domestic investments.

Conrad Burge, head of investments at Fiducian, said: “India today is a major global economy. Up until the arrival of [Indian Prime Minister] Narendra Modi, India was a relative fringe player on the global stage and attracted limited foreign investment that was mainly confined to companies prepared to accept the risk of waiting for long-term gains.

“Since Modi came to power, foreign direct capital investment (as distinct from share market or portfolio investment) into manufacturing and services has risen to around US $50 billion a year.”

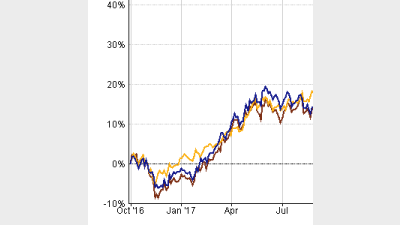

According to FE Analytics, India’s stockmarket the BSE Sensex has risen 47.9% over three years to 30 September, 2019 while the MSCI India index has returned 37%. This compared to returns of 35% by the broader MSCI Emerging Markets index.

Performance of BSE Sensex, MSCI India and MSCI Emerging Markets indices over three years to 30 September, 2019.

Recommended for you

A growing trend of factor investing in ETFs has seen the rise of smart beta or factor ETFs, but Stockspot has warned that these funds likely won’t deliver as expected and could cost investors more long-term.

ASIC has released a new regulatory guide for exchange-traded products (ETPs), including ETFs, on the back of significant growth in the market.

Assets in Macquarie Asset Management’s active ETFs have tripled to $2 billion in the last six months, helping the division deliver a net profit contribution of $1.1 billion.

With property becoming increasingly out of reach for young Australia, Vanguard has proposed a tax-incentivised scheme to help cash-heavy individuals build wealth.