Familiar faces lead way for global equities

The global equity sector has gained one more five Crown fund in the latest FE fundinfo Crowns rebalance, with eight new funds getting five Crowns.

There were 25 funds that received five Crowns in the latest rebalance of FE fundinfo’s quantitative measure in the sector within the Australian Core Strategies universe.

There were three funds that had three Crowns previously: AtlasTrend Big Data Big, AXA Investment Management Sustainable Equity and Insync Global Capital Aware.

Four funds that had four Crowns also now had five: Carnegie Worldwide Equity Trust, Evans And Partners International, Fidelity Global Demographics and Ironbark Royal London Concentrated Global Share.

Morningstar Global Shares was previously unrated and was now the eighth new five Crown fund in the sector.

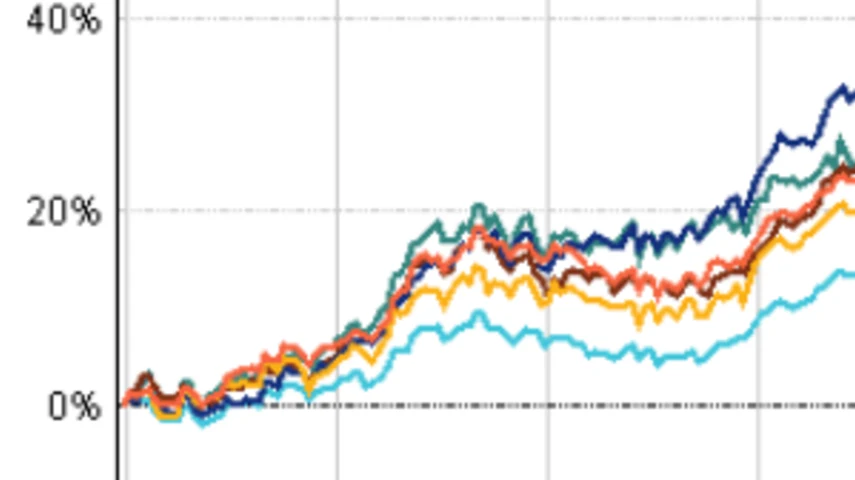

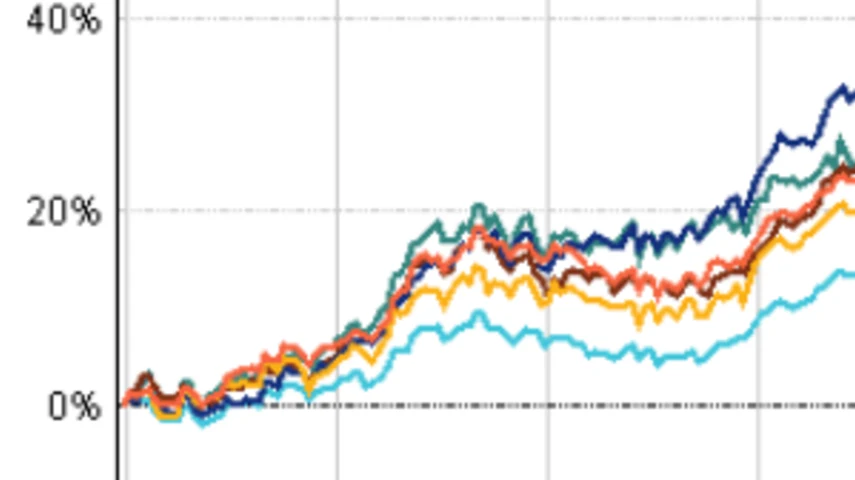

When it came to performance returns of the five Crown funds, Zurich Investments Concentrated Global Growth returned 82.99% over the three years to 31 December, 2019, according to FE Analytics.

This was followed by Hyperion Global Growth Companies (81.25%), Findex Global Growth (76.49%), Marsico CC Global (75.86%), and CFS Generation Global Share (74.97%).

Of the newly-rebalanced funds, Fidelity had the best return with 34.76%, followed by Insync (35.18%) and Evans and Partners (32.83%).

Best performing five Crown ACS global equity funds over the three years to 31 December 2019

Recommended for you

After introducing its first active ETF to the Australian market earlier this year, BlackRock is now preparing to launch its first actively managed, income-focused ETF by the end of November.

Milford Australia has welcomed two new funds to market, driven by advisers’ need for more liquid, transparent credit solutions that meet their strong appetite for fixed income solutions.

Perennial Partners has entered into a binding agreement to take a 50 per cent stake in Balmoral Investors and appoint it as the manager of Perennial's microcap strategy.

A growing trend of factor investing in ETFs has seen the rise of smart beta or factor ETFs, but Stockspot has warned that these funds likely won’t deliver as expected and could cost investors more long-term.