Does size matter?

Eight of the top 10 Australian equity funds were boutiques, showing that backing a big-name fund managing group does not always guarantee the best returns.

According to FE Analytics, within the Australian Core Strategies universe, over the last three years the top five best returns were from boutiques, including DDH Selector funds as the top two.

The best performer was DDH Selector Australian Equities which returned an annualised 20.06% over the three years to 31 December, 2019.

This was followed by DDH Selector High Conviction Equity A (17.76%), Platypus Australian Equities Trust Wholesale (16.78%), Bennelong Australian Equities (15.39%) and Bennelong Concentrated Australian Equities (15.07%).

The best institutional fund was BlackRock Concentrated Total Return Share E1 (14.91%), followed by Macquarie Australian Shares (13.74%).

The Australian Equities sector returned 9.13% annualised in that time period.

Top 10 Australian Equity funds with annualised returns, sharpe ratio and volatility v sector over the three years to 31 December 2019

|

|

Boutique |

15.07% |

1.07 |

11.27 |

|

Major fund manager |

14.91% |

0.97 |

12.22 |

|

|

Major fund manager |

13.74% |

1.05 |

10.09 |

|

|

Boutique |

13.51% |

1.05 |

9.68 |

|

|

Boutique |

13.40% |

0.97 |

10.28 |

|

|

Boutique |

13.16% |

0.82 |

13.02 |

|

|

ACS Equity – Australia |

Sector |

9.13% |

0.63 |

9.05 |

DDH was an independent boutique fund manager whose stock selection utilised a bottom-up approach based on quantitative research.

The appearance of Alphinity’s Sustainable Share fund was notable as it was a boutique environmental, social and governance (ESG) fund that focused on the advancement of the UN Sustainable Development agenda.

Stephane Andre, principal and portfolio manager for Alphinity, said the impact of market changes had helped their agenda.

“A very clear one [market change] would be the move away from thermal coal, so that means you have less demand for it,” Andre said.

“We wouldn’t invest in it in our sustainable fund, but our other [non-sustainable] funds are really re-considering these risks.

“There are a quite a few companies here that are supporting sustainable development goals.”

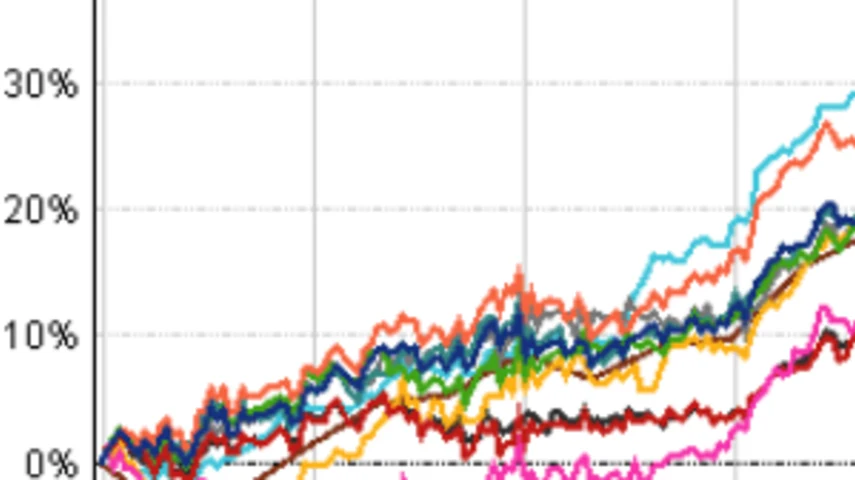

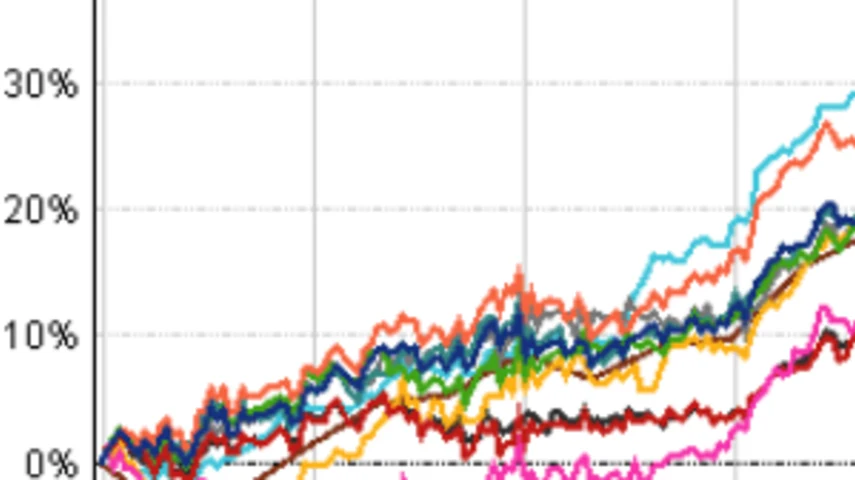

Top 10 performing Australian equity funds v sector over last three years to 31 December 2019

Recommended for you

After introducing its first active ETF to the Australian market earlier this year, BlackRock is now preparing to launch its first actively managed, income-focused ETF by the end of November.

Milford Australia has welcomed two new funds to market, driven by advisers’ need for more liquid, transparent credit solutions that meet their strong appetite for fixed income solutions.

Perennial Partners has entered into a binding agreement to take a 50 per cent stake in Balmoral Investors and appoint it as the manager of Perennial's microcap strategy.

A growing trend of factor investing in ETFs has seen the rise of smart beta or factor ETFs, but Stockspot has warned that these funds likely won’t deliver as expected and could cost investors more long-term.