DNR Capital’s fund added to six new platforms

DNR Capital has announced that its Australian Emerging Companies Fund has been added to six new platforms which included BT Wrap, BT Panorama, Macquarie Wrap, Netwealth, HUB24 and Praemium.

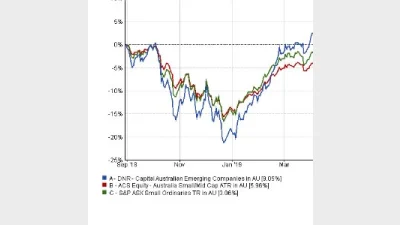

The fund offered investors exposure to 20-45 portfolios to quality Australian smaller companies. At 30 November, the fund exceeded its benchmark, the S&P/ASX200 Small Ordinaries accumulation Index, by 5.32% per annum since inception in August, 2018.

Robert White, DNR Capital Chief Executive Officer said that the fund was launched due to strong investor demand for access to our proven investment philosophy at the smaller end of the market cap spectrum.

“There is vast dispersion amongst the companies operating in the small cap universe. For the past 17 years DNR Capital has successfully identified businesses with strong quality characteristics in the large cap space,” Sam Twidale, lead Portfolio Manager for the strategy said.

“We are certainly finding that this same process is equally, if not more, effective at the smaller end of town”.

Recommended for you

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.

Investment manager Salter Brothers has partnered with private equity firm Kilara Capital to launch an Australian sustainable investment platform focusing on decarbonisation.

Fresh off launching three active ETFs to the Australian market, Avantis Investors is already planning to expand its range with two further products next year.

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.