Did you miss out on this golden opportunity in your portfolio?

Gold funds have dominated the commodities and energy sector in 2019 with the top six performing funds in the sector being gold focused, according to FE Analytics.

Gold funds had a large boost during June to September this year, and although it had tailed off over the last couple of months, the asset class has provided a reliable hedge against periods of market instability during this year and the end of last year. Analysts also forecast another volatile and uncertain year for 2020.

FE Analytics data found within its Australian Core Strategies universe, the commodity and energy sector average return was 15.98% over the year to 31 October, 2019. This was the sixth best performing sector out of the universe’s 37 asset classes.

The top performing funds in the sector were BetaShares – Global Gold Miners ETF Currency Hedged (57.76%), Market Access – NYSE Arca Gold BUGS Index EUR in AU (57.43%), Select – Baker steel Gold (54.03%), VanEck – Vectors Gold Miners ETF (50.27%), Perth Mint – Gold (26.22%), and BetaShares –Gold Bullion ETF AUD Hedged (21.20%).

VanEck – Australian Resources ETF (18.22%), State Street Global Advisors (SSGA) - SPDR S&P ASX 200 Resources (14.98%), BetaShares – Australian Resources Sector ETF (14.13%) and BT – Classic Investment BT Natural Resources (9%) followed the gold funds to round out the top 10.

The SSGA fund had half in basic materials (51.04%) and a quarter in oil and gas (25.42%); almost a third of its holdings in BHP Group (31.26%), followed by Rio Tinto (9.96), Woodside Petroleum (8.94%), Newcrest Mining (7.06%) and Fortescue Metals Group (4.51%).

The BetaShares – Global Gold Miners ETF regional weightings were largely concentrated to two key areas: North America (71.4%) and South Africa (16.5%).

Market Access – NYSE Arca Gold BUGS Index had 87.66% of its regional weighting in North America, with Newmont Goldcorp (14.83%), Barrick Gold Corp (14.01%), Agnico Eagle Mines (10.47%), Gold Fields (4.44%) and Helca Mining Co (4.32%).

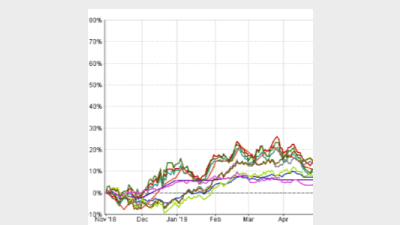

Best performing commodity and energy funds v sector over the year to 31 October 2019

Recommended for you

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.

Financial advisers have expressed concern about the impact including private market exposure is having on their tracking error budget, according to MSCI.

State Street will restrict its membership of global climate alliance Net Zero Asset Managers after the organisation dropped its flagship 2050 goals amid ESG backlash from the US.

Betashares has launched a global shares and a global infrastructure ETF as part of the firm’s strategic expansion strategy to support financial advisers in building more diversified portfolios.