Colchester launches EM bond fund

Colchester Global Investors has launched its Emerging Markets Bond fund as a diversifier for financial advisers for the income-generating allocations of their client portfolios.

According to FE Analytics data, the institutional version of the fund has returned 16.8% since its inceptions in December 2017, beating its average global bond sector peers that returned 8.1%.

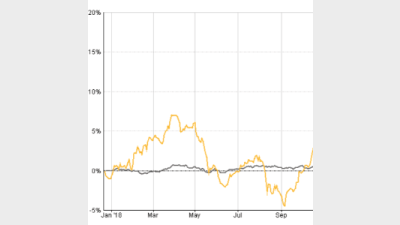

Colchester Emerging Markets Bond fund performance v sector since fund inception to 16 September 2019

Source: FE Analytics

Colchester head of distribution for Australia, Angela MacPherson, said the fund was not a substitute for developed market sovereign bonds but it offered attractive income, diversification and return characteristics.

“Relative to credit and hedge funds it can offer a liquid and simple alternative that may also have lower default risk; after all local currency emerging markets, as governments, can tax and print money which corporates cannot,” she said.

Colchester said the local emerging market debt index was primarily investment grade quality with over 80% of countries rated BBB- or above and the fund believed that former views of emerging markets being highly volatile was not prevalent today.

It said the markets it invested in had “improved balance sheets, prudent government and fiscal policies, and improving institutional frameworks which were increasingly consigning historical volatility to the past”.

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.