Centuria REIT announces acquisitions

Centuria Property Funds Limited (CFPL), a responsible entity (RE) of Centuria Metropolitan REIT (CMA), has announced the acquisition of two New South Wales-based (NSW) metropolitan office assets for $119.1 million, a capital raising around of $60 million, and an independent valuation providing an uplift of $33.8 million.

The fund also entered into a contract for the sale of 44 Hampden Road, Artarmon in Sydney’s north for $10.3 million, which represented a 14.4 per cent to its book value.

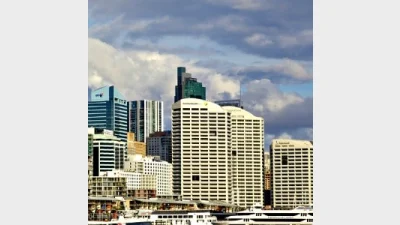

The acquisitions included an agreement to buy a 50 per cent interest in the neighbouring suburb of St Leonards at 201 Pacific Highway along with the acquisition of 77 Market Street south of Sydney in the city of Wollongong.

According to the firm, both acquisition represented ‘complementary properties’ to CMA’s existing portfolio and in line with its investment strategy.

They would be funded by a combination of equity and debt, with the issue price representing a 2.4 per cent discount to CMA’s closing price of $2.45 on 4 December, 2017.

With issue price, the new securities were forecast to deliver a 7.8 per cent FY18 distributable earnings yield and 7.6 per cent FY18 distribution yield, the company said.

According to independent valuation of the whole CMA portfolio, which was undertaken by CPFL as at 30 November, the expected increase of the property value represented a 4.5 per cent over prior valuations and was helped by strong market fundamentals, active asset management and increased investor appetite for non-CBD office assets.

CMA’s trust manager, Nicholas Blake, noted that the portfolio’s valuation was not surprising given investors’ increased demand for attractive yields relative to CBD office assets.

“Both acquisitions are highly complementary to our portfolio, and well positioned to deliver value for our securityholders,” he said.

“Centuria has been investing in metropolitan office properties for two decades, and this result further demonstrates our strong track record in securing quality assets and actively managing them to deliver superior return for investors.”

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.