Can Taiwan help investors during US/China trade war?

Taiwan has become a strong alternative for China funds, presenting itself as an attractive alternative as it wasn’t beholden to the whims of the US/China trade war, but still only makes up a fraction of the exposures.

For example, the Premium China fund had invested in Taiwan Semiconductor Manufacturing Co. (TSMC), which was entirely based outside of China and avoided US/China trade tensions. TSMC manufactured the semi-conductors related to 5G technology.

They had also invested in bike company Merida, which manufactured bikes and electric bikes, purely in Taiwan.

However, as of 30 September, only 7% of the portfolio was in Taiwan, which included 3.2% in Merida and 2.9% in food conglomerate Uni-President as the top holdings, with four stocks in total.

Jonathan Wu, Premium China Funds Management (PCFM) executive director and chief investment specialist, said navigating the trade war had been manageable.

“There’s ultimately two sides, you have the long-term trajectory of equities which still ultimately depends on earnings growth, but you have this other x-factor in the market called sentiment,” Wu said.

“It’s not a direct responsibility of the government, but to some extent the government has to ensure people are confident in their economy.”

“We believe we have been able to navigate the trade war because the universe of stocks is quite large so we don’t have to depend on one sector, but we can’t control the sentiment.”

Because of the wider investment universe available in the region, they were comfortable maintaining investment in areas of the Chinese economy that wouldn’t be as heavily affected.

Premium China’s top 10 holdings as of 30 September were Alibaba, Tencent, Nissan Foods, ANTA Sports Products, Merida and Uni-President.

“The parts of the Chinese economy the government is more in control of is property, because those related industries make one third of the gross domestic product of the country, which is the part of the economy the government can stimulate,” Wu said.

They had also invested heavily in consumer stocks, which focused on domestic consumption inside the country, which wasn’t impacted by the trade war.

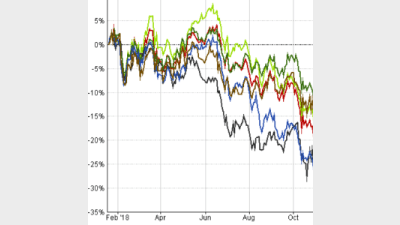

However, according to FE Analytics, since 19 January, 2018 – the Friday before US President Trump announced his first tariffs on China – the Premium China fund returned -8.57%.

In that same time period, Vasco China AMC returned -6.98%, Blackrock iShares China Large-Cap ETF returned -2.1%, Fidelity China returned 0.9%, and VanEck Vectors ChinaAMC CSI 300 returned 0.56%.

Performance of China funds since 19 January, 2018.

Recommended for you

After introducing its first active ETF to the Australian market earlier this year, BlackRock is now preparing to launch its first actively managed, income-focused ETF by the end of November.

Milford Australia has welcomed two new funds to market, driven by advisers’ need for more liquid, transparent credit solutions that meet their strong appetite for fixed income solutions.

Perennial Partners has entered into a binding agreement to take a 50 per cent stake in Balmoral Investors and appoint it as the manager of Perennial's microcap strategy.

A growing trend of factor investing in ETFs has seen the rise of smart beta or factor ETFs, but Stockspot has warned that these funds likely won’t deliver as expected and could cost investors more long-term.