Beware poor ESG in passive funds

Investors in passive emerging markets funds need to be wary of being invested in companies with poor environmental and social governance standards (ESG), according to Stewart Investors manager Jack Nelson.

Opting for an index or exchange traded fund (ETF) meant investors followed the benchmark which could typically contain large multi-nationals which did not always adhere to the best standards.

Nelson, who manages the Stewart Investors Wholesale Global Emerging Markets Sustainability fund, said: “It is difficult to screen for quality companies in a passive fund. Without taking an active approach then you can end up misallocated into bad companies.”

Many of the companies that scored poorly from an ESG perspective were state-owned enterprises, those companies where the state was the majority shareholder, a practice that was particularly big in countries such as Brazil, China and South Africa.

This state ownership then led to a misalignment between the strategic interest of the state and those of minority shareholders. However, they generally tended to have lower risk than the wider market as they were backed by the government and had higher dividend yields.

Nelson said financial and resources companies were also sectors which tended to score poorly on ESG standards.

Emerging market companies tended to score lower overall than their developed market counterparts on factors such as board, ownership and control and pay and accounting practices.

This was worsened, Nelson said, by the fact there was often limited corporate transparency or disclosure at emerging market companies which made them harder for managers to assess.

“There have been issues of corruption, the interactions between management and politicians can undo businesses and we have seen that repeatedly over the years. Also resources companies have had environmental disasters which make us wary,” he said.

“We are trying to find high quality companies run by people we can trust, which are resilient to change and financed in a conservative way.”

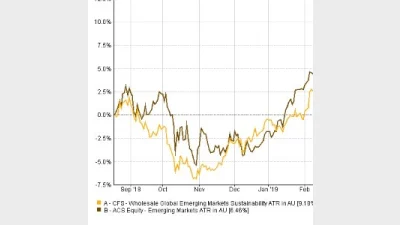

The Stewart Investors Wholesale Global Emerging Markets Sustainability fund has returned 9.1 per cent over one year to 19 August, according to FE Analytics, versus returns of 6.4 per cent by the ACS Equity-Emerging Markets sector.

Recommended for you

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.

Investment manager Salter Brothers has partnered with private equity firm Kilara Capital to launch an Australian sustainable investment platform focusing on decarbonisation.

Fresh off launching three active ETFs to the Australian market, Avantis Investors is already planning to expand its range with two further products next year.

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.