Australian equities fall behind international peers

Australian equities are faring worse than their geographic rivals with the biggest losses of major equity regions, despite strong performance during 2019, according to data.

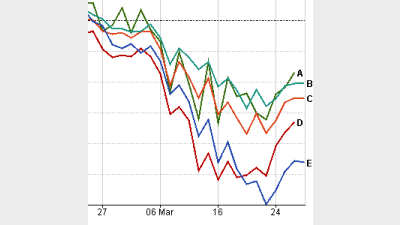

Looking at performance since the start of year Australian equity funds lost 26% compared to a loss of 13% over one year to 27 March, 2020, according to FE Analytics within the Australian Core Strategies universe.

This performance made the Australian equities sector the worst compared to its North American, European, Asia Pacific ex Japan and emerging market counterparts.

This was despite a strong run during 2019 when the sector returned 22% during the year to 31 December, 2019.

With the ASX 200 being down some 23% since the start of the year, many funds in this sector were down 20%-30% with the two worst funds being down 36%.

While all regions reported negative performance year to date, North American equity funds in the North American equities sector were least affected with losses of 8% year to date. The best performers in this sector were BetaShares US Equities Strong Bear ETF with returns of 53.9% followed by SSGA S&P 500 ETF Trust with returns of 6%.

Funds in the Asia Pacific equities sector were down 10%, the emerging market sector was down 12.6% and the European equity sector had seen a fall of 16.4% since the start of 2020.

North America was also the only one of two markets to report positive performance over the last 12 months with returns of 6.9%. The second market to see a gain was the Asia Pacific ex Japan sector which saw a smaller positive return of 0.2%.

The ranking was the same for both year to date and one-year performance – North America, Asia Pacific ex Japan, Emerging Markets, Europe and Australia.

Performance of North America, Asia Pacific ex Japan, emerging markets, Europe and Australia equity sectors since start of 2020

Recommended for you

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.

Morningstar Australasia is scrapping its controversial use of algorithm-driven Medalist ratings in Australia next year and confirmed all ratings will now be provided by human analysts.

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.