Aussie tech stocks surge past FAANGs

While the S&P ASX 300 Health care sector has had a good run in the last few years, the Information Technology sector has taken over, and Aussie tech stock are to blame.

According to Wealth Within’s chief analyst, Dale Gillham, FAANG stocks in the US are up an average of 25 per cent year-to-date with Netflix and Facebook up 40 and 26 per cent respectively.

But, impressive as that may be, Australia’s equivalent, WAAAX stocks (WiseTech Global, Afterpay Touch, Altium, Appen and Xero) are up an average of 52 per cent, which means, as of this year, Information Technology was the top performing sector, while historically financials and healthcare have been standouts.

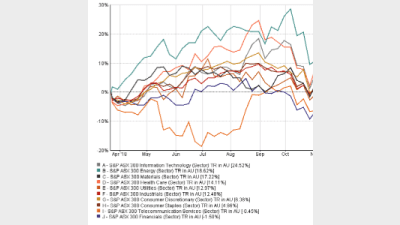

Data from FE Analytics shows for the 12 months to date, the Information Technology sector sat at 22.43 percent in the top spot, followed by materials, which sat at 18.31 per cent, and health care at 17.07 per cent.

It seems the aftereffects of the Banking Royal Commission may finally be felt by Financials, with the sector sitting in bottom position with -0.57 per cent returns.

The chart below shows the performance of the S&P ASX 300 sectors for the 12 months to date.

The analyst expected that, due to an aging population, constant new technologies emerging and decreasing manufacturing, healthcare and tech stocks would continue to soar in the next ten years, and form some of the country’s biggest companies.

Going forward, Gillham said while materials, information technology and consumer discretionary were the top gainers in the week past, the best opportunities in future would come from materials, energy and healthcare.

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.