Aussie investors pick local stocks and international ETFs

Australian investors were most often choosing local stocks and broad-based international exchange traded funds (ETFs) in 2019 as the S&P 500 surged 29% in US dollar terms, according to the analysis by Saxo Markets which looked at their Australian client base.

The most-traded ETFs among Saxo clients were broad-based ETFs with most of these securities being ETFs with overseas exposures. However, there was one exception from that rule and it was the most traded ETF – the Vanguard Australian Shares Index.

The other four that made it to the top five most often chosen ETFs by Saxo’ Australian clients and investors were: the Vanguard US Total Market Shares Index ETF (VTS), the Vanguard FTSE Emerging Markets Shares ETF (VGE), iShares Core S&P Mid-Cap ETF (IJH) and the SPDR S&P ETF Trust (SPY).

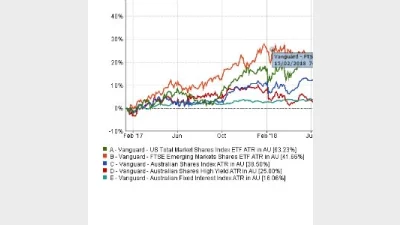

Top current holdings among Saxo clients in Australia included the following ETFs: Vanguard Australian Shares Index ETF (VAS), Vanguard US Total Market Shares Index ETF (VTS), Vanguard FTSE Emerging Markets Shares ETF (VGE), Vanguard Australian Fixed Interest Index ETF (VAF) and Vanguard Australian Shares High Yield ETF (VHY).

According to Saxo Markets, the top individual stock holdings consisted of only international tech companies that were not locally listed.

“Interestingly our Australian clients no longer seem to have a local bias when it comes to long-term stock holdings as they can see the opportunities that abound in international equity markets, particularly the US,” Adam Smith, Saxo Markets Australia chief executive, said.

“However, interest in local names does remain strong with ASX listed stocks becoming more actively traded.”

When it comes to ETFs, Smith said the situation was a little different and that there was a bit of crossover between the most traded ETFs and the most popular long-term holdings as there was “a lot of buying in this space”.

“Australian investors have been bulking up their portfolios with broad-based ETFs, a trend that is likely to continue for many years still,” Smith added.

The performance of top current ETFs over the three years to 31 December, 2019

Recommended for you

A growing trend of factor investing in ETFs has seen the rise of smart beta or factor ETFs, but Stockspot has warned that these funds likely won’t deliver as expected and could cost investors more long-term.

ASIC has released a new regulatory guide for exchange-traded products (ETPs), including ETFs, on the back of significant growth in the market.

Assets in Macquarie Asset Management’s active ETFs have tripled to $2 billion in the last six months, helping the division deliver a net profit contribution of $1.1 billion.

With property becoming increasingly out of reach for young Australia, Vanguard has proposed a tax-incentivised scheme to help cash-heavy individuals build wealth.