The Aussie healthcare stock outpacing rivals with near 700% returns

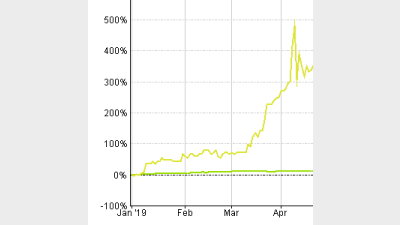

Shares in Australian healthcare firm Avita Medical rose 696% during 2019 and have risen 23% since the start of 2020.

The stock develops and markets regenerative medical products, particularly a spray-on skin used for burns patients known as RECELL which was approved by the US Food & Drug Administration (FDA) in September, 2018.

It was admitted to the ASX 200 in November, 2019 which it said was a “testament to the company’s solid growth trajectory following the commercialisation of the RECELL System combined with the strength of our de-risked pipeline of future indications beyond burns.”.

Its performance compared to returns of 23.4% by the ASX 200 during 2019 and 7.3% since the start of 2020, according to FE Analytics.

In the firm’s half-year results for the six months to 31 December, 2019, the firm said it may have the opportunity to take part in an FDA registration study on vitiligo and would be focusing more on burns and on trauma and soft tissue injuries.

Total revenue for the period was $13.5 million, more than double the $6.9 million reported for the same period in 2018 with the majority of product sales coming from the US after a successful launch of RECELL in January, 2019.

Performance of Avita Medical over the 12 months to 31 December, 2019 versus ASX 200

Recommended for you

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.

Morningstar Australasia is scrapping its controversial use of algorithm-driven Medalist ratings in Australia next year and confirmed all ratings will now be provided by human analysts.

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.