AMP Capital launches ESG strategy

AMP Capital has announced it will work towards six environmental, social, and governance (ESG) strategies for its real estate business for 2030.

AMP said the strategy aimed to address key sustainability challenges including climate change, waste, biodiversity, social impact, accessibility and supply chain sustainability.

AMP Capital’s head of sustainability, real estate, Chris Nunn said: “Sustainability has become a dominant global economic risk and business megatrend that will transform industries and society.

“The real estate sector holds many of the solutions and is in a position to act now. AMP Capital is committed to working with our industry peers, clients and customers to improve every day for future generations.”

The strategic aim the firm’s real estate business would work towards for 2030 included:

- To be zero net carbon for scope one and two emissions from operation of building incorporated services;

- To create a biodiversity conservation reserve that is equivalent in area to its entire managed real estate portfolio – more than four million square metres;

- to improve accessibility for the one in five people who have a disability across its managed assets; and

- Implement improved supply chain governance and work with partners to identify and address ESG-related supply chain risks such as modern slavery and materials safety.

AMP Capital also announced it agreed to acquire a 50% interest (approximately $880 million) in Macarthur Wind Farm on behalf of investors in its AMP Capital Community Infrastructure Fund (CommIF) and the AMP Capital Core Infrastructure Fund (CIF).

AMP Capital community infrastructure fund manager Charles Savage said: “We’re extremely pleased to have secured this asset for our investors. Macarthur Wind Farm is a unique and high-quality asset that meets CommIF’s objective to produce long-term, stable returns while delivering a positive social impact now and into the future.

“The transaction marks CommIF’s first investment in the renewable energy sector. It has an attractive risk profile that provides fixed revenues that are not exposed to price or volume risk. We remain excited by the pipeline of further opportunities in social and community infrastructure projects across Australia and New Zealand in 2020.”

CIF fund manager John Julian said the fund aimed to provide retail investors with both sustainable income and capital growth over the long-term and the acquisition was well-aligned to this objective.

The close of the deal is expected to be completed by the first quarter of 2020.

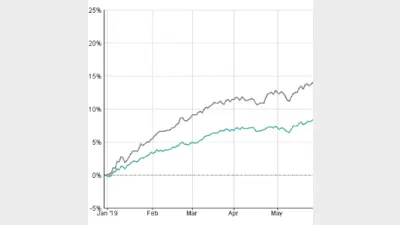

Over the three years to 31 October, 2019, the AMP Capital Core Infrastructure fund returned 12.66%, well below the infrastructure sector average of 20.3%, according to FE Analytics.

AMP Capital Core Infrastructure fund v sector performance three years to 31 October 2019

Recommended for you

Being able to provide certainty about redemptions is worth fund managers pursuing when targeting the retail market even if it means sacrificing returns, according to Federation Asset Management.

Regal chief investment officer Philip King will step down from listed investment company VGI Partners Global Investments after the LIC reported a loss of $17.6 million for FY25.

Real asset commentators have shared what advisers should be considering when conducting their due diligence on the assets and how they can mitigate illiquidity for retail clients.

GQG Partners has announced net flows were down 28 per cent in the first half of 2025, with redemption pressure particularly hitting Australia.