YBR moves to non-bank structure

Yellow Brick Road (YBR) Wealth Management will move to a non-bank organisational structure to take advantage of the expected fragmentation of the financial services industry.

The company has posted a wealth management update to the Australian Securities Exchange, in which it announced the creation of a non-bank holding company, which will own the business and will execute planned acquisitions in the financial services space.

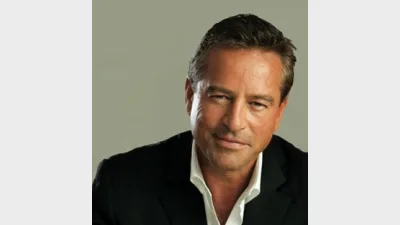

YBR executive chairman Mark Bouris said the new structure would help the company grow its distribution in various markets, including financial planning.

Bouris added there were already three acquisitions in the pipeline.

"These are currently subject to due diligence investigations and, whilst there is no guarantee that these acquisitions will be completed, there are strong strategic imperatives behind them for our group," he said.

YBR Wealth Management is also set to deliver its first profit in 2015, Bouris said, which would conclude its three-year strategy to organically build a profitable wealth management business.

The non-bank organisational structure will see the creation of a multi-channel distribution business model which the company hopes will "broaden and deepen" distribution relationships.

YBR Wealth Management will also place significant investment in its advice business, particularly in the area of technology and advice software.

Recommended for you

Compared to four years ago when the divide between boutique and large licensees were largely equal, adviser movements have seen this trend shift in light of new licensees commencing.

As ongoing market uncertainty sees advisers look beyond traditional equity exposure, Fidante has found adviser interest in small caps and emerging markets for portfolio returns has almost doubled since April.

CoreData has shared the top areas of demand for cryptocurrency advice but finds investors are seeking advisers who actively invest in the asset themselves.

With regulators ‘raising the bar’ on retirement planning, Lonsec Research and Ratings has urged advisers to place greater focus on sequencing and longevity risk as they navigate clients through the shifting landscape.