YBR confirms Vow Financial acquisition

Publicly-listed mortgage and financial services group Yellow Brick Road (YBR) has confirmed its move to acquire the Macquarie Bank-related Vow Financial.

The company announced to the Australian Securities Exchange (ASX) today that it had entered into an implementation deed with Vow, which it described as a privately-owned mortgage aggregator.

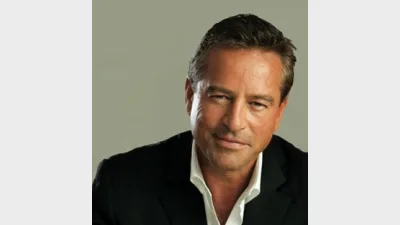

Commenting on the move, YBR executive chairman Mark Bouris said the acquisition was consistent with the company's strategy of becoming a leader in the non-bank segment.

"Vow will provide YBR with a new national distribution channel and business model, with its current access to over 700 mortgage broker groups," he said.

The ASX announcement said that the Vow Board had unanimously resolved to recommend acceptance of the YBR offer, noting that Tim Brown, chief executive of Vow, and Macquarie Bank, the largest shareholder, had accepted their respective offers.

It said that, in aggregate, these acceptances amounted to approximately 40 per cent of Vow's issued capital.

Recommended for you

Compared to four years ago when the divide between boutique and large licensees were largely equal, adviser movements have seen this trend shift in light of new licensees commencing.

As ongoing market uncertainty sees advisers look beyond traditional equity exposure, Fidante has found adviser interest in small caps and emerging markets for portfolio returns has almost doubled since April.

CoreData has shared the top areas of demand for cryptocurrency advice but finds investors are seeking advisers who actively invest in the asset themselves.

With regulators ‘raising the bar’ on retirement planning, Lonsec Research and Ratings has urged advisers to place greater focus on sequencing and longevity risk as they navigate clients through the shifting landscape.