Tasmanian financial adviser banned permanently

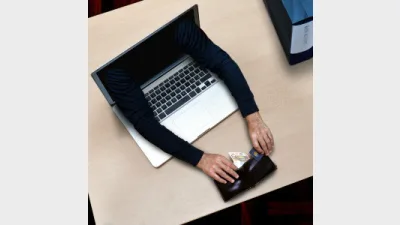

The Australian Securities and Investments Commission (ASIC) has permanently banned Tasmanian financial adviser, Kenneth David Drake, from providing any financial services in the future for stealing a total of $940,935.09 from two elderly clients of his practice.

He was formally convicted of two counts of stealing by the Supreme Court of Tasmania in April 2016, following an investigation by Tasmania Police, and was sentenced to six and half years in jail. Additionally, he will be eligible for parole only after serving half of his term.

According to ASIC, over the course of six years, Drake carried out 64 unauthorised transactions on his client's accounts and, on a number of occasions, he forged the signatures of the clients to facilitate the stealing.

ASIC deputy chairman, Pater Kell, said that ASIC would continue to remove people from the financial services industry who "act dishonestly and breach the trust of their clients".

Drake has the right to appeal to the Administrative Appeals Tribunal for a review of ASIC's decision.

Recommended for you

Compared to four years ago when the divide between boutique and large licensees were largely equal, adviser movements have seen this trend shift in light of new licensees commencing.

As ongoing market uncertainty sees advisers look beyond traditional equity exposure, Fidante has found adviser interest in small caps and emerging markets for portfolio returns has almost doubled since April.

CoreData has shared the top areas of demand for cryptocurrency advice but finds investors are seeking advisers who actively invest in the asset themselves.

With regulators ‘raising the bar’ on retirement planning, Lonsec Research and Ratings has urged advisers to place greater focus on sequencing and longevity risk as they navigate clients through the shifting landscape.