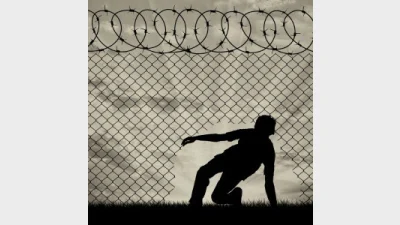

Just because it isn’t illegal doesn’t make it right

Conduct within the financial planning industry which has justified whistleblowing has not necessarily been illegal.

That is the bottom line of evidence given to the Parliamentary Joint Committee on Corporations and Financial Services as part of its inquiry into whistle-blower protections in the corporate, public and not-for-profit sectors.

Professor A.J. Brown of Griffith University’s Centre for Governance and Public Policy, has told the committee that circumstances had arisen where employees had identified a “sharp financial planning practice” but discovered that it was not actually illegal.

He said such a person might go to regulators such as the Australian Securities and Investments Commission (ASIC) or the Australian Prudential Regulation Authority (APRA) but there would be no point in going to the Australian Federal Police (AFP) because there had been no criminal offence.

Brown told the committee that it was possible that employees had raised their concerns stating a practice was wrong and should be illegal but it was not.

He claimed that often the response would be: “Will you just shut up. This is what we do”.

“Then the person has said, 'No. This literally is wrong. I'm going to go to APRA. I'm going to go to ASIC,' and that becomes known to the company, so then the company sacks him or her,” Brown said.

“And it might well be that ASIC—and I am literally just describing history here—turns around and says, 'Well, we couldn't see that there was anything unlawful, and, therefore, it'll be some time till we get around to dealing with it.' I am not saying that this is how ASIC works now; I am saying this is how ASIC might have worked in the past,” Professor Brown said.

He suggested that it was in these circumstances that he believed some other forum should be available to whistle-blowers.

Recommended for you

The central bank has released its decision on the official cash rate following its November monetary policy meeting.

ASIC has cancelled the AFSL of a Melbourne-based managed investment scheme operator over a failure to pay industry levies and meet its statutory audit and financial reporting lodgement obligations.

Melbourne advice firm Hewison Private Wealth has marked four decades of service after making its start in 1985 as a “truly independent advice business” in a largely product-led market.

HLB Mann Judd Perth has announced its acquisition of a WA business advisory firm, growing its presence in the region, along with 10 appointments across the firm’s national network.