Enforceable undertaking for Foster Stockbroking

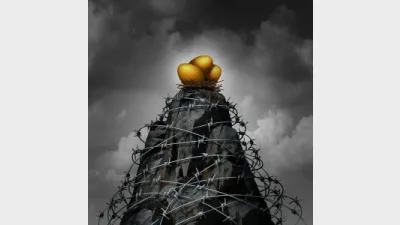

Sydney-based Australian financial services licensee, Foster Stockbroking is providing an enforceable understanding to the Australian Securities and Investments Commission (ASIC) following the regulator’s investigation into conflict of interest concerns at the firm.

ASIC found that Foster Stockbroking, the Sole Lead Manager for an initial public offering (IPO) of Reffind Limited (RFN) in 2015, had engaged in illegal conduct which saw the RFN IPO oversubscribed by at least 385 per cent.

“ASIC considers the process of allocating securities by stockbrokers in capital markets raisings should be efficient, honest and fair, and the publication by those stockbrokers of sell-side research on securities should be independent and objective,” said commissioner Cathie Armour.

“Ensuring this conduct meets these standards directly is necessary to ensure the integrity of financial markets and investor confidence in those markets.”

ASIC found that:

- There has been no effective separation of FSB's research function from its other functions and a research report about RFN was written by the head of investment banking at FSB, who had an ongoing corporate advisory role with RFN;

- Statements contained in the research in relation to its objectivity could have been misleading; and

- At the time of the publication of the report, both the head of investment banking and associates of FSB had significant holdings in RFN that were not adequately disclosed in the research.

The regulator said FEB has undertaken various processes to change its systems and controls to eliminate reoccurrence of the concerns.

Recommended for you

AZ NGA has partnered with an Adelaide-based accounting and financial planning practice as it expands its presence in South Australia.

The central bank has released its decision on the official cash rate following its November monetary policy meeting.

ASIC has cancelled the AFSL of a Melbourne-based managed investment scheme operator over a failure to pay industry levies and meet its statutory audit and financial reporting lodgement obligations.

Melbourne advice firm Hewison Private Wealth has marked four decades of service after making its start in 1985 as a “truly independent advice business” in a largely product-led market.