Capital raising leads to new acquisition for YBR

Yellow Brick Road (YBR) moved to acquire non-bank mortgage manager Resi, partly thanks to a recent capital raising arrangement.

After temporarily suspending its trade on the Australian Securities Exchange (ASX), the company revealed it has signed a $36 million acquisition deal with the lender to be paid in both cash ($28 million) and shares ($5.5 million YBR shares), with the remainder of the sum deferred for a year.

The settlement is expected to happen on August 29, subject to shareholder approval, which is the same date the previously announced acquisition of Vow Financial is due to be finalised.

The two acquisitions follow a period of capital raising by YBR, which saw it collect over $42 million through placement shares.

"Funds raised via the Placement will be used to pay, in part, the cash component of the purchase consideration for the Resi and Vow acquisitions and to provide general working capital for the Company," the ASX announcement said.

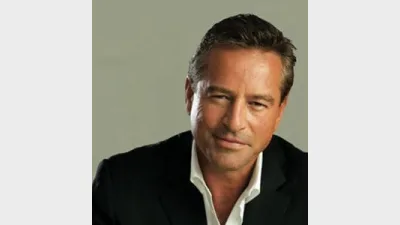

YBR has also renewed the contract of executive director, Mark Bouris, for another five years, at a base annual rate of $1,125,000.

Bouris' term was due to expire in June 2015.

Recommended for you

Compared to four years ago when the divide between boutique and large licensees were largely equal, adviser movements have seen this trend shift in light of new licensees commencing.

As ongoing market uncertainty sees advisers look beyond traditional equity exposure, Fidante has found adviser interest in small caps and emerging markets for portfolio returns has almost doubled since April.

CoreData has shared the top areas of demand for cryptocurrency advice but finds investors are seeking advisers who actively invest in the asset themselves.

With regulators ‘raising the bar’ on retirement planning, Lonsec Research and Ratings has urged advisers to place greater focus on sequencing and longevity risk as they navigate clients through the shifting landscape.