Australia’s HNWI population grows 9.2 per cent

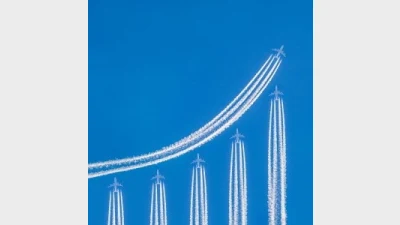

Australia’s high net worth individual (HNWI) population has grown 9.2 per cent, moving from 254,000 HNWIs in 2016 to 278,000 in 2017, a report from Capgemini has found.

According to Capgemini’s World Wealth Report 2018 (WWR), the improving global economy spurred global HNWI wealth to surpass the US$70 trillion threshold for the first time.

Registering its sixth consecutive year of gains, HNWI wealth grew 10.6 per cent, making 2017 the second-fastest year of HNWI growth since 2011, the report said.

Capgemini said the new report also highlighted the anticipated entry of BigTechs - or data-driven tech firms not traditionally present in financial services, such as Amazon, Google/Alphabet, Alibaba, Apple, and Facebook - into wealth management, as well as growing HNWI interest in cryptocurrencies, which reached an all-time high market capitalisation in January 2018.

“In Australia, we have seen superannuation savings provide a key contributor to HNWI growth,” said Philip Gomm, Capgemini Australia and New Zealand financial services practice lead.

“Superannuates with more than $1 million in investable assets will increasingly require the sophistication of hybrid investment services, where advanced analytics coupled with robotic processes can contribute to ongoing returns.

“The race is on to beat BigTech firms in providing the best investment performance analytics and automated processes on an intuitive, easy-to-use platform.”

Recommended for you

The Australian Financial Complaints Authority has reported an 18 per cent increase in investment and advice complaints received in the financial year 2025, rebounding from the previous year’s 26 per cent dip.

EY has broken down which uses of artificial intelligence are presenting the most benefits for wealth managers as well as whether it will impact employee headcounts.

Advice licensee Sequoia Financial Group has promoted Sophie Chen as an executive director, following her work on the firm’s Asia Pacific strategy.

The former licensee of Anthony Del Vecchio, a Melbourne adviser sentenced for a $4.5 million theft, has seen its AFSL cancelled by ASIC after a payment by the Compensation Scheme of Last Resort.