ASIC reminds CBA on its breach obligations

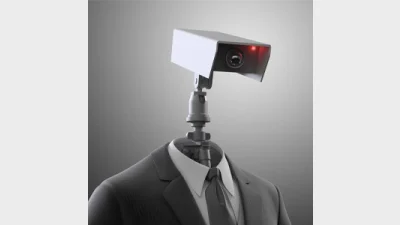

The financial planning activities of the Commonwealth Bank and the implementation of its new compensation arrangements will remain under close scrutiny by both the Australian Securities and Investments Commission (ASIC) and the Federal Government.

ASIC has responded to the Commonwealth Bank’s announcement of its so-called “Open Advice Review Program” by reminding the big banking group that it has ongoing obligations to report any breaches it uncovers as it implements its remediation program.

“In the event any breaches of law are identified in this program, ASIC requires those breaches to be reported in accordance with the law on breach reporting,” ASIC said in a formal statement. “The law requires that significant breaches or likely breaches are reported to ASIC as soon as practicable, or in any event within 10 business days of the licensee becoming aware of the breach or the likely breach.”

ASIC’s admonition with respect to the remediation process came at the same time as it declared that it was close to finalising the license conditions which would be imposed on the bank’s financial planning arms.

In the meantime, the Minister for Finance and Acting Assistant Treasurer, Senator Mathias Cormann has welcomed Commonwealth Bank chief executive, Ian Narev’s announcement of the Open Advice Review Program and stated that the Government will be monitoring its implementation.

Recommended for you

The top five licensees are demonstrating a “strong recovery” from losses in the first half of the year, and the gap is narrowing between their respective adviser numbers.

With many advisers preparing to retire or sell up, business advisory firm Business Health believes advisers need to take a proactive approach to informing their clients of succession plans.

Retirement commentators have flagged that almost a third of Australians over 50 are unprepared for the longevity of retirement and are falling behind APAC peers in their preparations and advice engagement.

As private markets continue to garner investor interest, Netwealth’s series of private market reports have revealed how much advisers and wealth managers are allocating, as well as a growing attraction to evergreen funds.