Zenith has been named Money Management’s Research House of the Year for 2014, taking the title from last year’s winner, Morningstar, writes Nicholas O’Donoghue.

After finishing the first part of Money Management’s annual Rate the Raters survey marginally behind Lonsec, the views of dealer groups pushed Zenith to the top, in what has been a tough year for some of its competitors.

The call for submissions from Money Management coincided with key events impacting two of Australia’s five research houses.

As Money Management was tabling its responses, an illiquid investment in van Eyk’s Blueprint International Share Fund by a UK investor froze redemptions in four of the research house’s Blueprint funds and saw van Eyk move into voluntary administration six weeks later.

Meanwhile Lonsec’s parent company, Lonsec Fiscal Holdings, announced it was reviewing its future strategy and may be in the market for a strategic partner, as the survey period drew to an end.

High quality staff, excellent client service and good value for money have formed the backbone of Zenith’s steady rise to the top of the Money Management Rate the Raters survey in recent years.

While the research showed that Zenith topped the ratings across a range of categories – including for the number of respondents subscribed to its services (66.66 per cent) – van Eyk Research recorded the lowest overall ranking, with one in three respondents reporting that they had stopped using its services in the last three years.

The survey found that Morningstar had the second highest subscription rating amongst respondents (29 per cent), followed by Lonsec (21 per cent) and Mercer (17 per cent), while just four per cent reported that they subscribed to van Eyk’s service.

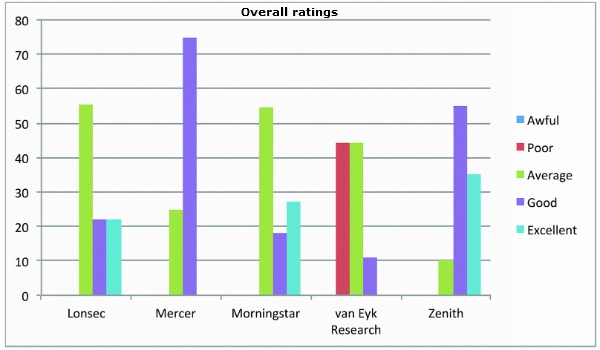

Overall

The 2014 Rate the Raters Dealer Group survey saw Morningstar’s combined ‘good’ and ‘excellent’ score of 100 per cent in 2013 slip to 45.45 per cent, among those who rated its service.

However, Zenith recorded a significant swing over the last 12 months, with 90 per cent of users rating its service as ‘good’ or ‘excellent’, up from 65 per cent. And for the second year in succession, it secured the highest ‘excellent’ rating (35 per cent) – although it marked a decline from 41 per cent in 2013.

Morningstar was not alone in seeing its combined ‘good’ and ‘excellent’ ratings slip, with Lonsec rating of 85.7 per cent last year falling to less than 45 per cent, however the ratings house’s ‘excellent’ rating jumped from 7.1 per cent to 22.22 per cent in the latest survey.

Meanwhile, Mercer saw a significant swing in its fortunes, with 75 per cent of respondents who rated its service as ‘good’ and no ‘poor’ ratings, compared with a 71.4 per cent ‘poor’ overall score last year.

While van Eyk scored the lowest overall score of the five major ratings houses, with just 11.11 per cent of respondents descripting it as ‘good’ and none rating it as ‘excellent’, however the research group’s poor rating improved from 62.5 per cent in 2013 to 44.5 per cent in the latest survey.

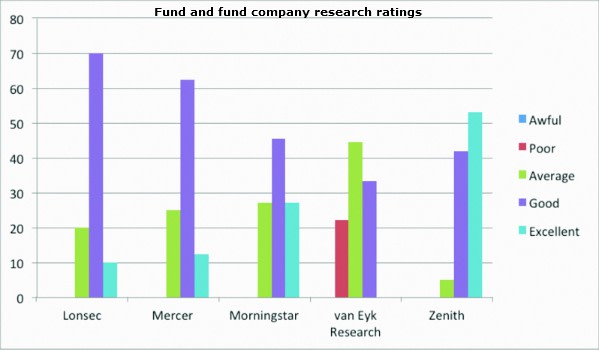

Fund and fund company research

Fund and fund company research was rated as the most important and essential service a ratings house provided its clients by all those who took part in the 2014 Rate the Raters Dealer Group Survey.

van Eyk again brought up the rear with two thirds of respondents rating its fund and fund company research as ‘average’ (44.44 per cent) to ‘poor’ (22.22 per cent), a significant decline from the company’s 87.5 per cent ‘good’ and 12.5 per cent ‘excellent’ scores in the 2013 survey.

However, van Eyk was not alone in seeing its ‘excellent’ rating slips, with Mercer the only research house to record an increase in its ‘excellent’ score – rising from zero to 12.5 per cent over the last 12 months. Mercer also turned its boosted a ‘good’ rating from 25 per cent to 62.5 per cent this year.

While Zenith’s ‘excellent’ rating dipped from 56.3 per cent in 2013 to 53 per cent in the latest survey, it topped the list for excellence in the category, ahead of Morningstar (27.27 per cent), while Lonsec was rated as ‘excellent’ by just one in ten of its users.

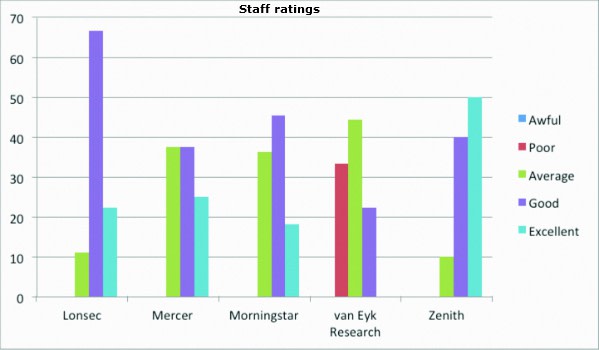

Staff

Dealer groups ranked the quality, experience and turnover of ratings houses’ staff as the second most ‘essential’ feature of a research company.

Again Zenith topped the table in this area, with 50 per cent of respondents describing the company’s staff as ‘excellent’, and a further 40 per cent rating them as ‘good’.

While the result showed a significant improvement on the 2013 survey, when almost 30 per cent of respondents rated Zenith’s staff as ‘poor’, it represented a 8.8 per cent fall in the proportion of those who viewed the company’s staff as ‘excellent’ 12 months ago.

Commenting on the performance of Zenith’s team, one respondent praised their professionalism.

“They are great guys and have built an excellent team of people, they are always professional in their dealings, their information is client friendly, their updates are market timely and our group loves their research,” they said. “We are very happy with them as our research providers.”

Meanwhile, one in four respondents, who rated Mercer’s staff believed they were ‘excellent’ – up from zero in 2013, however, it’s 100 per cent ‘good’ ranking for staff slipped to 37.5 per cent, with the same proportion of respondents viewing their performance as ‘average’.

Morningstar was the only other research house to record an improvement in its ‘excellent’ rating for its staff – rising to 18.18 per cent from 15 per cent last year. But again growing numbers of respondents saw the company’s staff as ‘average’ – 36.36 per cent.

Lonsec’s staff were the second most highly regarded in 2014, with two thirds viewed as ‘good’ by respondents and a further 22.22 per cent describing them as ‘excellent’ – down from 28.6 per cent in the last survey.

Again, van Eyk trailed the pack, with a third of respondents rating the company’s research staff as ‘poor’ – the only research house to receive such a rating in this category – while the proportion of people viewing its staff as ‘excellent’ fell from 12.5 per cent in 2013 to zero.

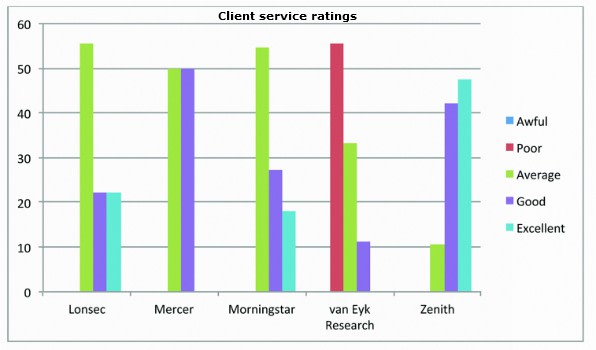

Client service

A third of all respondents rated research houses’ client service as an ‘essential’ part of a rating house’s offering.

Zenith topped the table for its client service, securing a 47.5 per cent ‘excellent’ rating, a slight increase on last year’s survey, well ahead of Lonsec (22.22 per cent) and Morningstar (18.18 per cent).

However, Zenith’s combined ‘good’ and ‘excellent’ scores fell from 100 per cent to 89.5 per cent, with just over one in ten respondents who rated its client service describing it as ‘average’.

While Lonsec and Morningstar had the second and third highest ‘excellent’ ratings of the major research houses, they also polled the highest and second highest ‘average’ ratings from their users (55.55 per cent and 54.54 per cent respectively).

Mercer again showed signs of improvement in this category according to respondents, half of whom described its performance as ‘good’, up from 14.3 per cent in the 2013 survey, while the other half said the company provided ‘average’ client service.

van Eyk’s ratings also improved on last year, with its ‘poor’ rating declining from 62.5 per cent in 2013 to 55.55 per cent this year. However, the company’s ‘good’ rating dropped from 25 per cent to 11.11 per cent, as a third of respondents deemed its client service to be ‘average’.

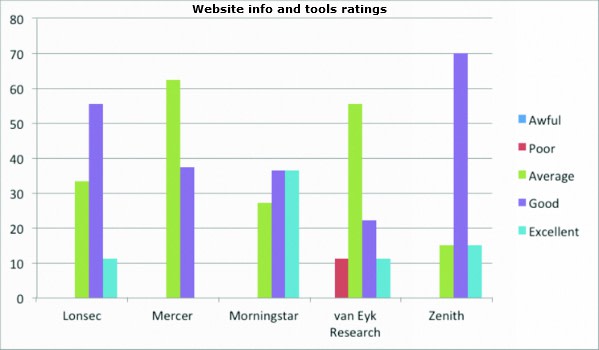

Website information and tools

A quarter of all respondents deemed that the quality of research houses’ websites was an ‘essential’ offering, while almost 60 per cent said it was “very important”.

Morningstar recorded the highest proportion of respondents who described its website offering as ‘excellent’ – 36.36 per cent, a fall from 81 per cent in the 2013 survey.

The category was also van Eyk’s strongest, according to users of its research, with 88.88 per cent of respondents rating its website as ‘average’ or better. However the result saw a fall in its ‘excellent’ rating from 25 per cent last year to 11.11 per cent.

While 100 per cent of respondents who rated Mercer said its site was ‘average’ or ‘good’, a similar result to the 2013 survey.

Respondents also indicated that Lonsec’s website offering had improved somewhat over the year, with its ‘poor’ rating falling from 46.7 per cent in the last dealer group survey to zero, however, the proportion of users who saw it as ‘excellent’ also declined from one in five, to just over one in 10.

Although this was one of Zenith’s weaker areas, users saw an improvement in its website, with 15 per cent rating it as ‘excellent’ – up from zero in 2013 – and a further 70 per cent describing it as ‘good’, while its ‘poor’ rating fell from more than a third of respondents last year to none.

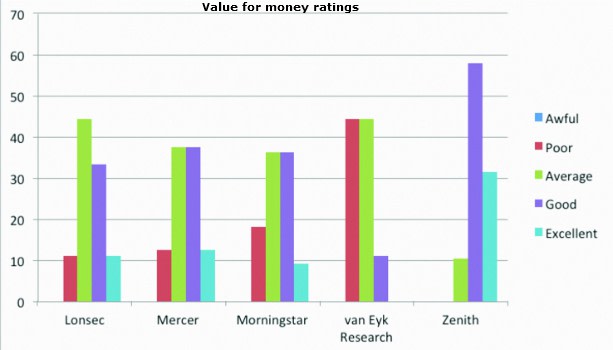

Value for money

Three-quarters of respondents to the dealer group survey believed that the value for money a research house offered was ‘very important’ or ‘essential’.

Once again Zenith topped the charts when it came to the value it offered dealer groups, according to respondents, with almost 90 per cent as either ‘good’ (58 per cent) or ‘excellent’ (31.5 per cent) – up from 65 per cent in 2013. It was also the sole research house not to receive a ‘poor’ rating in this category.

Mercer also improved its value for money rating among its users over the last 12 months, with 50 per cent of users saying it was ‘good’ or better, compared to the 85.7 per cent of respondents who viewed it as ‘poor’ a year ago.

Both Lonsec and van Eyk also experienced a fall in the proportion of users who felt their services offered ‘poor’ value for money, dropping from 57.1 per cent and 62.5 per cent to 11.11 per cent and 44.44 per cent respectively.

While the other major research houses received improved ratings for the value for money they offered dealer groups, Morningstar was the only one to see a rise in the proportion of ‘poor’ ratings it received, rising from zero in 2013 to 18.18 per cent this year.