The long-term implications of COVID-19 for emerging markets

In the wake of the global COVID-19 economic slump, and associated negative impact on global supply chains, tourism, and export demand – we have seen profound central bank easing. Indeed, the breadth of central bank easing across global capital markets is totally unprecedented with a net 153 policy rate cuts in the past six months, since COVID-19 became a pandemic.

As such, widespread policy rate cuts have been matched by equally aggressive bouts of money printing – referred to as quantitative easing (QE) – and new fiscal policies (including direct loans to companies, and substantially increased unemployment benefits). The aggressive policy response to COVID-19, especially QE, continues to be led by the US, Europe, Japan, and other developed markets.

Away from rate cuts, emerging market (EM) policy initiatives in terms of gross domestic product (GDP) continue to be comparatively restrained. EM central banks are very mindful of potential currency vulnerabilities if they attempt aggressive QE – without reserve currencies. Additionally, many EM governments have a general commitment to conservative fiscal policy (some dictated by legislation), typically as a result of past experiences during episodes of economic/fiscal crises. This has led to a much milder monetary and fiscal response from EM to the economic shock of COVID-19 relative to developed markets.

With limited unemployment benefits and an inability to control social distancing for sustained periods, the EM working population will go back to work almost by necessity – otherwise there is a risk of widespread civil unrest. Further, given EMs much younger populations (median age 28), the death rate would seem to be materially lower in any case at this stage, given approximately 97% of COVID-19 deaths occur in people aged over 55 years and 75% above 70 years.

Accordingly, despite rising cases and tragic deaths, lockdowns have started to ease across most EM countries – even the worst hit COVID-19 country, Brazil, announced a winding back over the past two months. Whilst we do not rule out the possibility of national lockdowns recurring (under second wave risks) – our base case for EMs is a continuance of surgical/localised lockdowns to try and contain the virus – which have a much lower negative economic impact.

LONGER-TERM IMPLICATIONS FOR EMS

In our view, the long-term COVID-19 implications on the EM will be material and we see a number of structural/geopolitical changes:

1. The continued rise of technology

COVID-19 has accelerated the adoption of technology across a range of applications and industries. Consumers and corporations are being forced to adopt technology just to survive in the current climate. By some estimates, we have seen the equivalent of three to five years of digital disruption in just three to five months and we believe we are still in the early stages of this megatrend. While e-commerce is an obvious play on this theme, we also see opportunities in the leading EM semiconductor, memory, factory automation, IT services, and telco companies.

2. Healthcare – increased focus on prevention

Increased focus on hygiene will see minimum standards raised, in both advanced and emerging economies. This is likely to see a permanent upshift in the annual demand for preventative healthcare items such as rubber gloves. Prior to COVID-19, India used just four gloves per capita per annum which has now increased to 30 gloves per capita per annum, which translates to 30 billion pieces per annum, and adds nearly 10% to incremental global demand from just one country.

We note that following SARS in 2003, the ongoing normalised annual rate of growth was in fact higher than pre-SARS. We see this recurring under COVID-19. The Malaysian rubber glove companies have been a long-standing core holding in our EM strategy. They remain a superb ‘hedge’ should the global pandemic worsen, and we believe the market is still under-estimating the earnings upside from the sector.

3. Travel – will be reduced for some time

International air transport, which has been severely impacted by travel bans, has historically recovered to normalised growth within a year after a pandemic. However, given the severity of COVID-19 and its true global impact, we expect travel to be significantly curtailed for some time. While there are selective opportunities in quality monopoly assets which we see as offering favourable risk-reward, our view on the transport sector more generally is that it will remain challenged for some time to come.

4. China – becoming more isolated

We see COVID-19 imposing lasting damage on China – at a basic level it will make it harder for the country to attract foreign capital, and accelerate the “de-globalisation/onshoring” of supply chains that was already underway due to the ongoing trade dispute with the US. China’s loss will be Taiwan, South Korea, South East Asia and India’s gain. With further evidence of the realignment of global supply chains, there are selective opportunities across EMs that we believe will be the beneficiaries of this trend.

5. Individual emerging markets – winners and losers

The EMs are not a homogeneous group and the economic and healthcare outcomes from COVID-19 will vary widely. Amongst the worst-hit markets have been Brazil, Russia and South Africa, which Northcape classifies as ‘least preferred’ markets on a top-down basis. Conversely, several markets which have had better COVID-19 outcomes, such as Taiwan, Korea, Malaysia, and Thailand, which rank amongst our ‘most preferred’ sovereigns.

We also have a favourable view on markets such as India, where a lot of pain has been worn, but there is light at the end of the tunnel, and we view equity valuations as attractive.

SUMMARY

In the short-term, we don’t know how COVID-19 and the capital markets impact will play out as this is tightly linked to the ‘medical outcomes’, which are near-impossible to predict. Ultimately, we do believe that this pandemic will pass, and an effective vaccine should be found – however, it will likely be at least 24 months away. This will see economic growth for EM normalise gradually over the next two years.

From a strategic investment standpoint, we believe investors need to focus on absorbing the COVID-19 growth shock and the sustained impact of the US-China tensions. Our focus is on investing in:

- Companies with no or very low levels of debt;

- Companies that generate strong internal free cashflows;

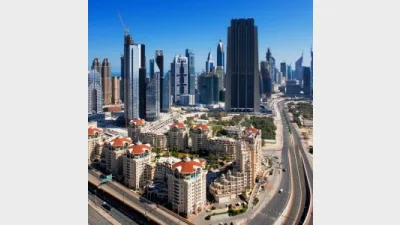

- Low exposure to commodity-linked companies and petro-countries (Russia and Middle East), whose prospects are tethered to China;

- Sizeable underweighting of China which in our view will be the largest long-term casualty of COVID-19 and US trade/IP/human rights restrictions;

- Overweight countries that benefit from foreign direct investment (FDI) pivoting from China;

- Overweight in healthcare – especially preventative items;

- Overweight towards selective technology and telecoms companies.

From our experience, using indiscriminate sell-offs in high-quality stocks to add to a portfolio is a better strategy than undertaking ‘catch-up buying’ when markets turn – because in our view the recovery will be sharply to the upside.

It can be hard to stomach at the time, but the best returns will be made buying into “doom and gloom” when valuations are attractive on a long-term basis.

Patrick Russel is emerging market equity strategy director, portfolio manager and analyst at Northcape Capital.

Recommended for you

As the industry shifts from client-centric to consumer-centric portfolios, this personalisation is likely to align portfolios with investors’ goals, increasingly reflect their life preferences, and serve as a gateway to rewards and benefits.

Managing currency risk in an international portfolio can both reduce the volatility, as well as improve overall returns, but needs to be navigated carefully.

In today’s evolving financial landscape, advisers are under increasing pressure to deliver more value to clients, to be faster, smarter, and with greater consistency.

Winning one premiership can come down to talent, luck, or timing but winning multiple ones indicates something deeper and successful is at play, writes Darren Steinhardt.