RETIREES

Australian retirees now need to look for a new approach to income as outdated portfolio strategies have been vulnerable to low interest rates and share market volatility,...

The Federal Budget lacks any measures to improve the access of financial advice nor does it have measures to support self-funded retirees, the Association of Financial Ad...

The investment industry needs greater focus on protecting retirees’ second biggest asset in drawdown phase, writes Jacqui Lennon....

The threat of sequencing risk is “diabolical” for retirees and pre-retirees and leaving them in danger when there is a market collapse, according to Cor Capital. ...

It is “critical” for retirees to avoid panicking and cashing out their investments if they wish to benefit from any economic recovery. ...

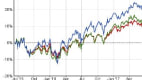

New regulators’ policies combined with lower earnings across many sectors may have far-reaching implications for retirees as well as companies and investment managers, ac...

The Government has announced that workers who lose their jobs will be able to drawdown $10,000 from their superannuation to cover losses caused by COVID-19. ...

The centrality of superannuation as a retirement vehicle has been reinforced by new research revealing the financial insecurity felt by current retirees....

Submissions directed to Treasury around the end of grandfathering revealed little significant resistance but genuine concern around how client rebates should work....

Confidence and satisfaction levels among retirees who have entered advice partnerships are high and the impact of expert financial advice should not be underestimated, ac...

Most Australian retirees are not involved with any financial professionals and navigate their way through their retirement finances independently, according to Franklin T...

The Government needs to avoid placing at a disadvantage people who have already retired and who have established their investment settings, according to the Association o...

Retirees living off cash-linked income will have their income further “crimped” by the RBA’s latest rate cut....

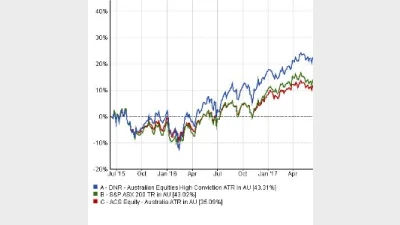

Financial advisers may need to help retirees increase their defensive equity allocations to protect capital, according to Vertium Asset Management....

Investors were avoiding exposure to stocks with franking in the run-up to the election, with DNR Capital warning they should not base investment decisions solely on tax. ...

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...