FE ANALYTICS

With the Reserve Bank’s June rate cuts intended in part to stimulate consumer spending, a dive into FE Analytics reveals which funds stand to gain the most from an uptick...

Fidelity is topping up its holdings in companies exposed to China to take advantage of the negative sentiment caused by the US/China trade war. ...

Laura Dew writes that the Australian Commodities and Energy sector has recovered well since the end of the mining boom, with demand for resources now extending beyond jus...

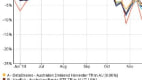

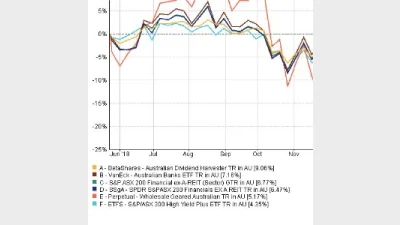

The banks were some of the biggest winners in the post-Federal Election share market rise last week, and data from FE Analytics shows which funds were best positioned to ...

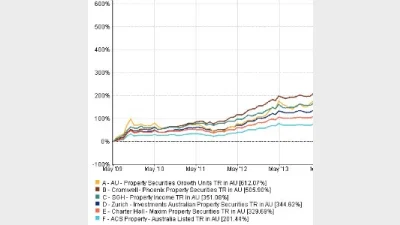

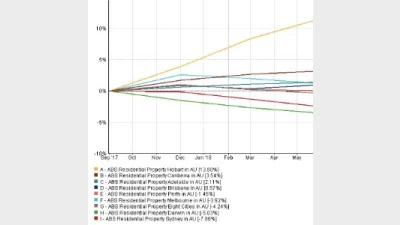

As the spectre of a recession looms, property funds are looking increasingly attractive as both a hedge against equities downturn and, as data from FE Analytics reveals, ...

Hexavest is standing by its conviction of being underweight US technology stocks, in the belief the companies are failing to live up to expectations....

Exchange-traded funds haven’t been offered on the Australian market for long. Their presence is already being strongly felt however, and Hannah Wootton looks at which pro...

Laura Dew writes that the SGH Emerging Companies Fund is bouncing back from a difficult 2018 with a focus on technology and resources stocks....

Anastasia Santoreneos writes that investors seeking diversification should take hold of what’s been coined the only free lunch in finance: alternative beta strategies. ...

April’s end marked the 19th consecutive month of house price declines since they peaked in September 2017, with one economist predicting that the downturn won’t end until...

The United States and Chinese economies are showing improvements, and a recession may no longer be imminent. ...

Anastasia Santoreneos writes that investors looking for a little less exposure to market volatility and a little more value need look no further than absolute return stra...

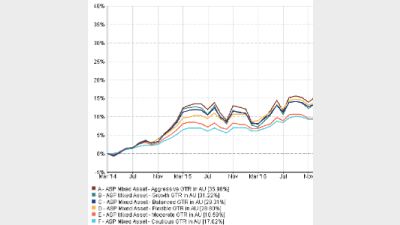

With consumers showing apathy toward swapping out of MySuper options, it’s worth considering whether their returns actually suffer much harm from staying put in the defau...

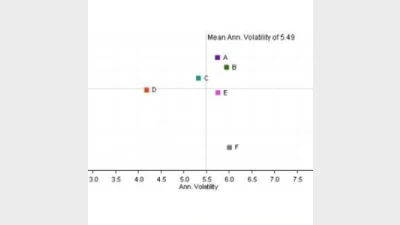

Many of the top performing superannuation funds’ growth options from the last three years have delivered on returns without compromising much on risk, data from FE Analyt...

Anastasia Santoreneos writes that while global fixed interest markets were volatile over 2018, signs of progress with US/China trade negotiations could see credit spreads...

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...