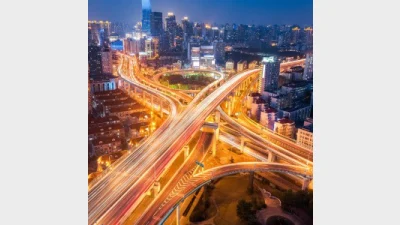

Now is the time to invest in infrastructure

Now is time to invest in infrastructure as infrastructure spend is expected to be increasingly utilised as a policy tool for further stimulus due to the COVID-19 pandemic, according to Martin Currie.

However, the challenge was the undisputed infrastructure investment gap around the world, given that in developing countries the ability to deliver these types of projects would be even more pronounced due to severely curtailed by a combination of financing shortfalls, and a lack of relevant skills.

“For most sub-Saharan and central Asian countries, there has been a dearth of any infrastructure building since their independence. At the same time, western donors have been steadily retreating from the financing of ‘hard’ infrastructure such as roads and bridges, in favour of ‘soft’ infrastructure, such as the promotion of governance, education, healthcare and water treatment,” the manager said in a report.

“Partly, this is due to an escalating concern of the potential environmental, social and governance (ESG) liability risks.”

Martin Currie said that these three observations were key:

- Higher infrastructure spend has helped economies recover from previous crises;

- Given rising urbanisation and aging infrastructure, infrastructure spend is essential not just for the short-term economic boost, but also for lasting productivity benefits; and

- Rising private sector involvement in funding infrastructure will be likely given stretched government finances.

“In the developed world, infrastructure has taken a back seat to alternative approaches to stimulus, but we expect this will not be the case going forward as economies reopen and people return to work,” it said.

“Given rates are already close to zero in many countries, governments will increasingly look to focus on infrastructure to stimulate economies given the lasting impact of this spend and the boost in productivity this spend provides. Ongoing population growth and the age of infrastructure around the world provides a compelling rationale for increased spending.

“Infrastructure spend has saved us before and will no doubt be used again.”

Recommended for you

Milford Australia has welcomed two new funds to market, driven by advisers’ need for more liquid, transparent credit solutions that meet their strong appetite for fixed income solutions.

Perennial Partners has entered into a binding agreement to take a 50 per cent stake in Balmoral Investors and appoint it as the manager of Perennial's microcap strategy.

A growing trend of factor investing in ETFs has seen the rise of smart beta or factor ETFs, but Stockspot has warned that these funds likely won’t deliver as expected and could cost investors more long-term.

ASIC has released a new regulatory guide for exchange-traded products (ETPs), including ETFs, on the back of significant growth in the market.