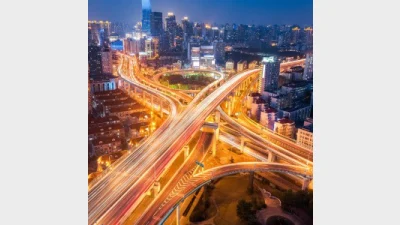

Macroeconomic outlook benign for infrastructure

The infrastructure sector is expected to see a relatively benign year ahead however investors should remain aware of technological disruption, according to RARE Infrastructure.

The Sydney-based global listed infrastructure investment manager said that although it expected a stable operating environment in 2018, any deviation from expectations could cause an outsized movement in asset prices.

Also, while there might be volatility, RARE did not expect major corrections due to significant cash on the sidelines.

According to the manager, there would be three key themes that would drive the infrastructure market in 2018.

RARE Infrastructure’s co-chief executive and co-chief investment officer, Nick Langley, said: “First is asset based growth – companies investing in their underlying assets to generate future returns, rather than buying or building new assets.”

“Second is price elasticity of demand. We believe that, as companies need to be careful not to increase prices beyond the consumer’s willingness to pay.

“Third and arguably the theme with the greatest potential to change markets is technological disruption. Investors are starting to consider, and be wary of, the impacts of changes in technology on the way we utilise our infrastructure, and there may be some winners and losers out of that.”

According to Langley, the disrupters within the infrastructure sector included: the falling cost of battery energy storage, greater penetration of renewable power generation, increased inter-connection of electricity network and the greater prevalence of electric vehicles.

Some of the RARE’s funds are:

Recommended for you

Financial advisers have expressed concern about the impact including private market exposure is having on their tracking error budget, according to MSCI.

State Street will restrict its membership of global climate alliance Net Zero Asset Managers after the organisation dropped its flagship 2050 goals amid ESG backlash from the US.

Betashares has launched a global shares and a global infrastructure ETF as part of the firm’s strategic expansion strategy to support financial advisers in building more diversified portfolios.

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.