Is it a good time for investors to turn to the defensives?

Australian investors might want to consider global listed infrastructure stocks which have traditionally a low correlation to the AUD, domestic equities and global bonds at the time of turmoil caused by the recent outbreak of coronavirus which spooked markets, RARE Infrastructure says.

According to Nick Langley, co-founder and senior portfolio manager at RARE Infrastructure, investor portfolios should always contain some level of defence that as long as it was appropriate for the investor's objectives or market conditions.

At the same time, their portfolios should remain prepared to accommodate any negative events whether it was the tech bubble burst, the global financial crisis (GFC), or a global health crisis.

“An ideal ‘defence’ investment is one whose value is to some extent insulated from the full force of a market downturn but will experience a reasonable percentage of the upside when the market moves in a positive direction,” Langley said.

“Fixed interest and cash are generally regarded as the default defensive asset classes but another is listed infrastructure, which is RARE’s singular speciality.

“Within this asset class, we favour regulated assets such as water and energy distribution – poles, wires and gas pipelines - which have high income but low exposure to fluctuations in GDP,” he said.

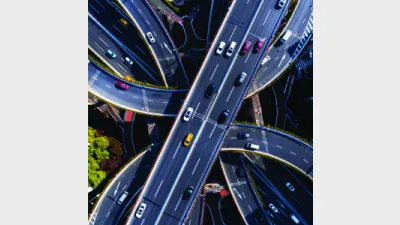

“These defensive ‘defence’ investments can be mixed with user-pay assets which generally have concession-based contracts with toll roads, rail, ports and airports but typically have lower income returns and are relatively higher leveraged to GDP.”

Recommended for you

Natixis Investment Managers has hired a distribution director to specifically focus on the firm’s work with research firms and consultants.

The use of total portfolio approaches by asset allocators is putting pressure on fund managers with outperformance being “no longer sufficient” when it comes to fund development.

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.