DNR Capital fund ‘approved’ by Zenith

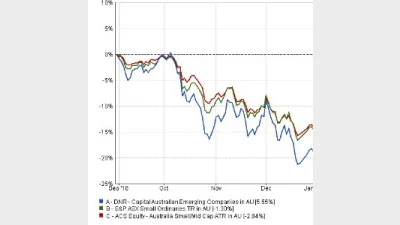

DNR Capital has announced that its Australian Emerging Companies Fund has received an ‘approved’ rating from Zenith Investment Partners and ‘investment grade’ from Lonsec.

The fund, which was available to advisers on a several platforms (Netwealth, HUB24 and Praemium), was launched last year and offered investors a concentrated exposure to Australian small companies.

Lonsec praised the fund for its bottom up stock selection approach while Zenith rated highly the fact that the investment team adopted broad research coverage.

“Although Twidale and Sedawie are responsible for the research coverage of all companies in the Fund's smaller companies universe, they draw upon the insights of the broader investment team. Zenith believes this is a positive for the Fund,” Zenith reported.

“We are seeing growing interest in this Fund and are encouraged by the support from consultants, advisers and investment platforms that have listed the Fund to their investment menu,” DNR Capital’s chief executive, Robert White, said.

“DNR Capital has generated a consistent track record of outperformance over the last 16 years, and we are confident of repeating this in the small cap sector.”

Recommended for you

Financial advisers have expressed concern about the impact including private market exposure is having on their tracking error budget, according to MSCI.

State Street will restrict its membership of global climate alliance Net Zero Asset Managers after the organisation dropped its flagship 2050 goals amid ESG backlash from the US.

Betashares has launched a global shares and a global infrastructure ETF as part of the firm’s strategic expansion strategy to support financial advisers in building more diversified portfolios.

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.