Alphinity global fund added to BT Panorama

The Alphinity Global Equity Fund has been added to BT’s Panorama platform and is now available on the four platforms including HUB24, MLC (Wrap and Navigator) and Netwealth.

According to the fund’s portfolio manager, Jonas Palmqvist, the addition would boost the team’s efforts to grow their retail footprint.

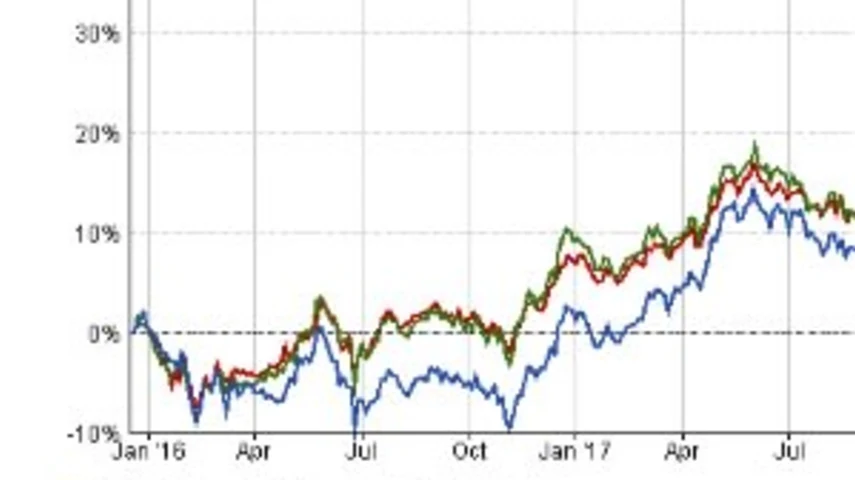

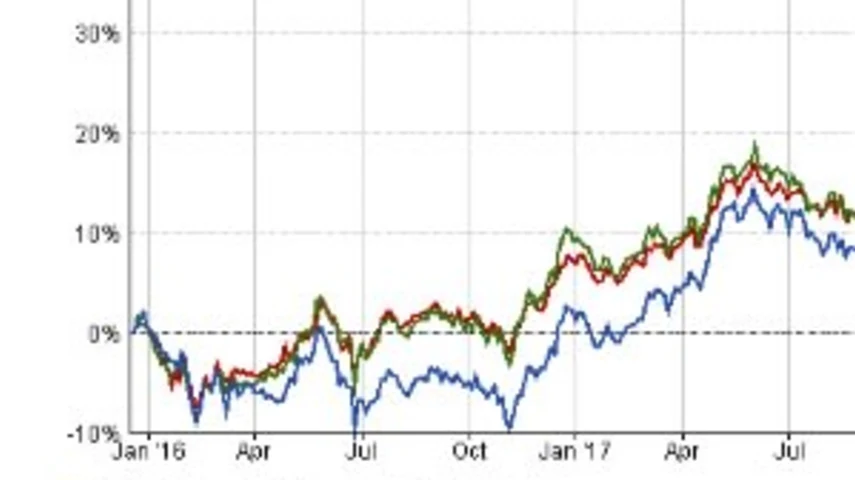

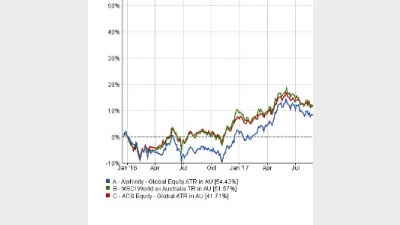

The Alphinity Global Equity Fund, which has $1.6 billion in funds under management (FUM), holds typically between 30 and 40 stocks across a broad diversity of market sectors and regions and outperformed MSCI World Net Return (AUD) across all reported time periods to 31 July, returning 16.8 per cent per annum over three years, the firm said.

“We’re delighted that the fund is now available to BT Panorama clients and we anticipate the recognition will bring increased adviser interest in the fund,” Pamlqvist said.

“Alphinity Global’s investment philosophy is to provide investors with an actively managed exposure to a high conviction portfolio of leading global companies with underappreciated earnings growth potential.”

The firm uses a combination of detailed analyst-driven fundamental research and specific targeted quantitative inputs.

The fund is managed by four Alphinity’s global portfolio managers: Jeff Thompson, Lachlan MacGregor, Nikki Thomas and Jonas Palmqvist.

Recommended for you

Retailisation of private markets such as evergreen funds may seem like appealing options for wholesale and retail investors, but providers risk undermining trust if their products are unclear.

Ethical investment manager Australian Ethical has seen its funds under management rise by a third over FY25 to close out the year at $13.9 billion.

BlackRock Australia’s head of intermediary distribution James Waterworth has taken up a new distribution role at an alternative asset manager, while Antipodes has hired a distribution director.

BlackRock’s iShares ETFs have reported a record first half for inflows, gaining US$192 billion in the past six months, to see overall ETF assets under management rise to US$4.7 trillion as it launches its first active ETF in Australia.