Planners not linked to IOOF allegations

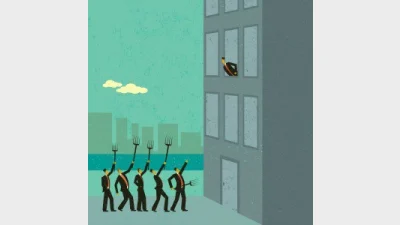

Financial advisers are not connected to the newspaper allegations confronting IOOF and to suggest that any link exists is mischievous, according to IOOF managing director, Chris Kelaher.

The e-mail also stated "the suggestion that a whistleblower has been poorly or inappropriately treated is also incorrect and misleading".

"The individual concerned at no time initiated the IOOF whistleblower policy. Rather it appears as though he obtained internal files unlawfully and has retained them for his own purposes for a significant period," it said. "His employment was terminated during the Fair Work hearing for, among other things, possessing and repeatedly ignoring requests to return these files."

It added that the "Fair Work case is confidential and neither IOOF nor the employee are permitted to comment" but added that "further legal action is likely.

"Finally, we should all understand these are not adviser nor financial advice related issues and to link them to financial advice is mischievous," the e-mail said.

Kelaher used the e-mail to staff to outline the company's position and has restated that the issues raised by the Fairfax media organisation are "largely historic in nature (2008 and 2009)" and "were dealt with as considered appropriate at the time".

"The issues were not, and are not, systemic in nature, rather individuals acting contrary to company policy and values. It is an unfortunate fact that this happens in many businesses — we are no exception," his e-mail said.

He said the two individuals in question had "left the firm many years ago" and that the allegations against other individuals were also dealt with by management at the time.

Recommended for you

Despite the year almost at an end, advisers have been considerably active in licensee switching this week while the profession has reported a slight uptick in numbers.

AMP has agreed in principle to settle an advice and insurance class action that commenced in 2020 related to historic commission payment activity.

BT has kicked off its second annual Career Pathways Program in partnership with Striver, almost doubling its intake from the inaugural program last year.

Kaplan has launched a six-week intensive program to start in January, targeting advisers who are unlikely to meet the education deadline but intend to return to the profession once they do.