New RE for Timbercorp managed investment schemes

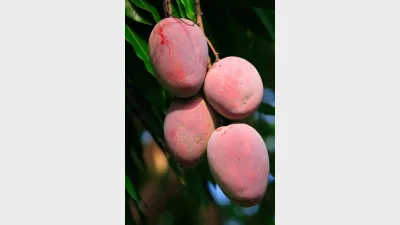

Huntley Management has been appointed as the new responsible entity (RE) of Timbercorp’s mango and avocado schemes.

At a meeting in Melbourne this morning, investors voted overwhelmingly in favour of appointing Huntley. The vote on the 2005 mango scheme was 734 investors in favour, the 2006 mango scheme was 665 for, and the 2007 mango and avocado scheme was 1,451 voting for a change of RE.

Siger Super Services adviser Kerree Bezencon, who was representing clients invested in the schemes, said these investors now had some certainty.

“The new RE can’t just up the costs of the schemes, but there will have to be some discussion about future fees,” she said.

“However, the investors will have the ability to walk away from the scheme if they feel there is no future for the crops.”

Bezencon said today’s vote illustrated what can be achieved when investors and advisers join forces.

“If we all pull together, we can achieve a positive outcome,” she said.

Timbercorp administrator Korda Mentha had earlier said the schemes were unviable and should be sold. As the administrator had become the RE by default, due to existing RE Timbercorp Securities being put in administration, investors were arguing the move was not in their best interest and the decision was being taken without independent research.

The second creditors meeting of the Timbercorp Group will be take place in Melbourne on Monday.

Money Management understands there will be strong opposition to any attempts by Korda Mentha to wind up any schemes at the meeting.

Recommended for you

The number of active advisers on the HUB24 platform has risen to more than 5,200, helping it see quarterly inflows of $5.2 billion.

ASIC has banned a Melbourne-based financial adviser for eight years over false and misleading statements regarding clients’ superannuation investments.

CFS has formed a strategic partnership with the University of Sydney to support the responsible development of AI solutions in the wealth management sector.

Increasing traction among high-net-worth advisers and a stabilisation in adviser exits have helped Praemium report quarterly net inflows of $667 million in the third quarter of 2025.