Helping women make money

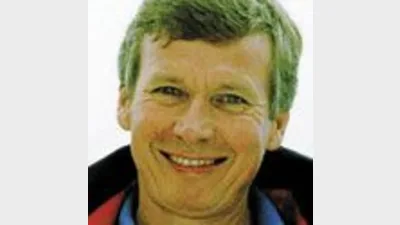

Paul Clitheroe

Although they have good budgeting skills and savings habits, most women have little confidence in their ability to invest their money and plan for a comfortable retirement, according to a new report by the Australian Government-run Financial Literacy Foundation.

Foundation chairman Paul Clitheroe said the organisation, together with the Government’s Office for Women and Security4Women, had used the findings of the report to develop a series of information sheets for women on a range of financial issues.

Entitled ‘Women understanding money’, the 14 information sheets cover everything from budgeting to investing and making the most of superannuation. They include personal case studies, tips and jargon busters to help women of all ages get their finances on track.

The report, Financial Literacy — Women understanding money, is based on a study of women’s attitudes and perceived abilities on a range of money issues.

The study found that although 70 per cent of women are confident in their ability to manage money, they are less likely than men to invest in anything other than their own home (43 per cent of women compared with 49 per cent of men), say that they understood financial jargon (60 per cent of women compared with 68 per cent of men), believe in their ability to plan for the long-term (77 per cent of women compared with 84 per cent of men) and plan for a comfortable retirement (60 per cent of women compared with 65 per cent of men). Women were, however, more likely than men to say they budget for day-to-day finances (53 per cent compared with 44 per cent) and invest in their own home (64 per cent compared with 60 per cent).

The study also found that most women were keen to improve their money management skills, which Clitheroe said the information sheets should help them do.

“Women are more likely to have time outside the paid workforce and lower incomes which, in the end, means less superannuation. Not only that, women’s savings need to go further because they tend to live longer. The information sheets provide practical information for women on making plans for the future while dealing with the money issues they face today.”

The report and information sheets can be found on the foundation’s website: www.understandingmoney.gov.au

Recommended for you

The central bank has released its decision on the official cash rate following its November monetary policy meeting.

Melbourne advice firm Hewison Private Wealth has marked four decades of service after making its start in 1985 as a “truly independent advice business” in a largely product-led market.

HLB Mann Judd Perth has announced its acquisition of a WA business advisory firm, growing its presence in the region, along with 10 appointments across the firm’s national network.

Unregistered managed investment scheme operator Chris Marco has been sentenced after being found guilty of 43 fraud charges, receiving the highest sentence imposed by an Australian court regarding an ASIC criminal investigation.