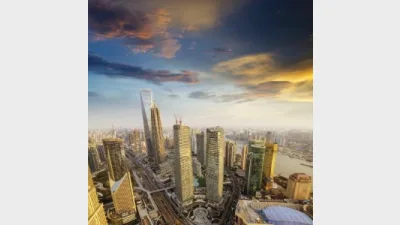

Governance warning as Asian markets boom

Asia’s financial market is tipped to usurp both the US and Europe in the next 15 years to become the prime global powerhouse, an ANZ report suggests.

The landmark study of financial systems, prepared by ANZ’s chief economist Warren Hogan, found Asia, which currently occupies around 22 per cent of the global system, could account for half by 2030.

Asian bond markets are forecast to grow to six times their current size over the period, while equity market capitalisation is tipped to “explode” to US$55 trillion, from its current US$9 trillion.

The “techtonic shift” will more broadly benefit global markets, with a wider spread of financial flows.

“Instead of the benign flow of official capital into deep, liquid government bond markets, particularly US

treasury bonds, Asia’s private sector will have a much bigger role in allocating Asian savings around the world,” Hogan said.

However, the transformation will be dependent upon the reform and deregulation of many Asian nations, according to the report.

“Government policy will be crucial in mitigating any problems as Asia develops a large, open and sophisticated financial system,” Hogan said.

“The decisions Chinese policymakers make in coming years will be of great importance to the global financial system.”

Improved access to capital, as well as refined legal structures, will also be key, Hogan said.

Recommended for you

The top five licensees are demonstrating a “strong recovery” from losses in the first half of the year, and the gap is narrowing between their respective adviser numbers.

With many advisers preparing to retire or sell up, business advisory firm Business Health believes advisers need to take a proactive approach to informing their clients of succession plans.

Retirement commentators have flagged that almost a third of Australians over 50 are unprepared for the longevity of retirement and are falling behind APAC peers in their preparations and advice engagement.

As private markets continue to garner investor interest, Netwealth’s series of private market reports have revealed how much advisers and wealth managers are allocating, as well as a growing attraction to evergreen funds.