FSI will do nothing to change status quo

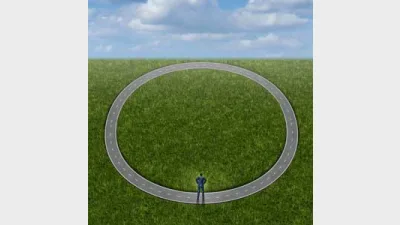

The Financial System Inquiry (FSI) will not change anything and the status quo will be maintained, according to a finance/insurance broker.

Self-employed Australian financial services licence holder Tony Canvin said there will be oblique observations made about the way things have panned out with events like Storm Financial, but nothing will change.

Canvin, who worked for merchant and investment banks like the First Boston Corporation until the 1990s, said the fact that the head of the inquiry, David Murray, was once the head of the Commonwealth Bank of Australia shows that it is "the inmates in the asylum investigating themselves".

"The banks will have, if you like, the vertical integration they've got now, which to me is just amazing that it has arisen and has been allowed to rise," he said.

Vertical integration should be taken to task, and it should be proven that things like the Storm Financial collapse was a direct result of it, he said.

"If the Commonwealth Bank had had its way it would've bought Storm way back then. Now it's got its Storm. You can imagine what the next tragedy's going to be like."

"Conflicts of interest, whether they are there or not, appear to be there. The fact that they own financial advisors who give ‘independent financial advice' to people who are looking for that independent advice...it beggars belief that an investment advisor wouldn't be selling the bank's products.

Canvin believes any review should get down to the fundamentals and separate the bankers from the fund managers.

"Once you move from that you've got to say if an investment adviser is an adviser, he must be truly independent; therefore not obligated to anybody about anything. He must be able to be free from the leverage of employment, and give complete independent advice."

He also believes the legislation should set out a framework where the banks, fund managers and insurance companies should not be interdependent upon each other.

Recommended for you

A strong demand for core fixed income solutions has seen the Betashares Australian Composite Bond ETF surpass $1 billion in funds under management, driven by both advisers and investors.

As the end of the year approaches, two listed advice licensees have seen significant year-on-year improvement in their share price with only one firm reporting a loss since the start of 2025.

Having departed Magellan after more than 18 years, its former head of investment Gerald Stack has been appointed as chief executive of MFF Group.

With scalability becoming increasingly important for advice firms, a specialist consultant says organisational structure and strategic planning can be the biggest hurdles for those chasing growth.