ClearView warns on FSC insurance terms ‘race to bottom’

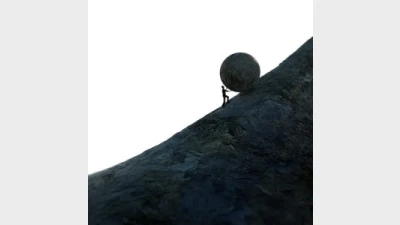

ClearView Wealth has specifically warned a key Parliamentary Committee against following an industry approach being led by the Financial Services Council (FSC) around standardised life insurance policy definitions, arguing they will create “a race to the bottom”.

In a submission filed with the Parliamentary Joint Committee on Corporations and Financial Services, ClearView managing director, Simon Swanson has declared that his company is concerned about the approach being headed by the FSC.

The submission acknowledges that policy wordings can be complex and confusing and that the industry should strive to create definitions that “are truly clear, concise and effective” but argues that the FSC approach based around product terms definitions needs careful reassessment.

It said the FSC approach:

• Potentially creates a "race to the bottom" (and/or no motivation to rise above the

bottom);

• Presents the real risk of stifling creativity and innovation in life insurance products,

including the types of changes discussed above; and

• Ultimately doesn't help deal with the existing legacy product maintenance issues

present in the industry (and potentially just exacerbates them).

Elsewhere in the ClearView submission, the company has expressed its strong support for the law being changed to allow life insurance companies to “proactively manage claims” to get clients back to work sooner by providing rehabilitation and allied health support benefits.

“Allowing life insurance companies to proactively manage claims by providing rehabilitation and allied health support services will benefit society by increasing the likelihood of people returning to work and good health,” the submission said.

Recommended for you

The top five licensees are demonstrating a “strong recovery” from losses in the first half of the year, and the gap is narrowing between their respective adviser numbers.

With many advisers preparing to retire or sell up, business advisory firm Business Health believes advisers need to take a proactive approach to informing their clients of succession plans.

Retirement commentators have flagged that almost a third of Australians over 50 are unprepared for the longevity of retirement and are falling behind APAC peers in their preparations and advice engagement.

As private markets continue to garner investor interest, Netwealth’s series of private market reports have revealed how much advisers and wealth managers are allocating, as well as a growing attraction to evergreen funds.