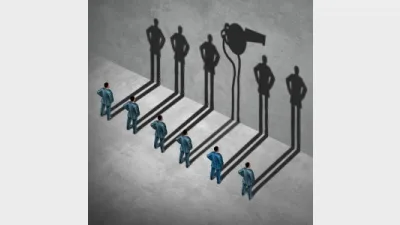

Whistleblower laws miss management and corporate behaviours

Many behaviours within the financial services industry that might be considered unethical and lead to whistle-blowing do not currently breach Australian laws, according to the Finance Sector Union (FSU).

The union has urged changes to the laws to enable a greater capacity to deal with management behaviours and practices.

The union has used a submission to the Senate Economics Committee inquiry into Whistleblower Protections to argue that the laws governing whistle blowing within the finance sector should cover at least the following:

- Any activity that breaches Australian law;

- Any activity that breaches an internal code of practice and/or code of behaviour;

- Any activity that breaches an accepted industry wide code, for example the Code of Banking Practice;

- Management and/or remuneration systems that are designed to drive behaviours that bring a significant risk of disadvantage or exploitation of customers; and

- Management behaviours that encourage, force or reward behaviours that ignore a customer's best interest in order to secure the sale of a product or service.

The submission said that the reason the laws were needed to cover behaviours and work systems was that many of the behaviours that would be considered unethical did not currently breach Australian laws.

The FSU submission said the union's position was that the existing whistleblower protection laws did not provide sufficient legal protection for a finance sector employees to risk their employment to raise examples of unethical behaviour or corporate misconduct with either internal or external parties.

Recommended for you

The Reserve Bank of Australia (RBA) has lowered rates to a level not seen since mid-2023.

Financial Services Minister Stephen Jones has shared further details on the second tranche of the Delivering Better Financial Outcomes reforms including modernising best interests duty and reforming Statements of Advice.

The Federal Court has found a company director guilty of operating unregistered managed investment schemes and carrying on a financial services business without holding an AFSL.

The Governance Institute has said ASIC’s governance arrangements are no longer “fit for purpose” in a time when financial markets are quickly innovating and cyber crime becomes a threat.