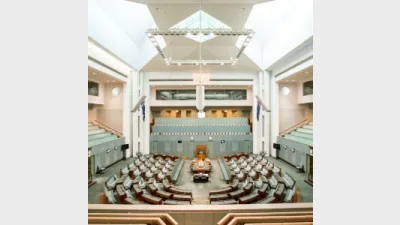

Parliament no wiser on how Industry Super Australia is funded

A Victorian Liberal Senator has fallen well short in her quest to winkle out the precise details of how Industry Super Australia (ISA) is funded despite asking pointed questions during Parliamentary committee hearings.

During the Senate Economics Committee inquiry into the non-payment of the Superannuation Guarantee (SG) which was largely prompted by ISA research, Victorian Liberal Senator, Jane Hume asked for “some detailed analysis of how ISA is funded”.

In doing so, Hume said she was placing the question on notice and did not mind whether the answer was received confidentially.

Responding to the question on notice, the ISA’s Canberra-based Director of Public Affairs, Matthew Linden simply reiterated verbal evidence he had given to the committee hearing with his written response saying he could confirm the evidence he provided on the day in relation to the funding of ISA “including scaled contributions from member funds based on size (like other industry bodies operating in the superannuation sector)”.

“Further I can confirm:

- Industry Super Australia receives funding annually from its 15 member funds for the express purpose to undertake collective projects on behalf of these funds with the objective of maximising the retirement savings of their five million members.

- These projects include research, policy development, government relations and advocacy as well as the well-known Industry SuperFunds Joint Marketing Campaign

- Details of participating funds can be found at http://www.industrysuper.com/choose-afund/

- Industry Super Australia received no additional funding for the research undertaken on unpaid super.

Recommended for you

The Reserve Bank of Australia (RBA) has lowered rates to a level not seen since mid-2023.

Financial Services Minister Stephen Jones has shared further details on the second tranche of the Delivering Better Financial Outcomes reforms including modernising best interests duty and reforming Statements of Advice.

The Federal Court has found a company director guilty of operating unregistered managed investment schemes and carrying on a financial services business without holding an AFSL.

The Governance Institute has said ASIC’s governance arrangements are no longer “fit for purpose” in a time when financial markets are quickly innovating and cyber crime becomes a threat.