Worst Aussie equity funds had large Big Four exposure

A lack of focus in real estate, but a focus on financials was the common theme among the worst performing Australian equity funds over the year to 31 October, 2019, according to FE Analytics data.

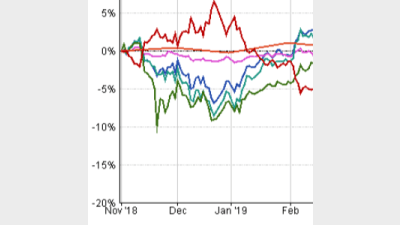

However, only BetaShares’ Australian Equities Bear Hedge (-15.78%) and Perpetual’s Pure Value Share (-0.18%) had negative returns.

The other worst performing Australian equity funds were, APSEC’s Atlantic Australian Equity (1.48%), Lazard’s Select Australian Equity and Pentalpha’s Income for Life (4.43%).

BetaShares’s Australian Equities Bear Hedge, which sought to generate returns negatively correlated to the market, had succeeded to almost exactly mirror the ACS Equity – Australia sector overall, which had returned 15.84%.

Pentalpha, Perpetual and Lazard all had sizeable holdings in the big four banks; basic materials, financials and money markets were the top sectors.

This is in contrast to the top two best performing funds, Yarra Australian Real Assets Securities and Legg Mason Martin Currie Real Income which both had at least 50% focused on property.

Pentalpha’s major holdings were Scentre Group (11.8%), Origin Energy (10.9%), Westpac (9.7%), Suncorp (9.3%), NAB (8.9%) and ANZ (8.6%).

Perpetual’s major holdings were in Suncorp (6.59%), Event Hospitality and Entertainment (6.45%), Commonwealth Bank (6.33%), Graincorp (6.13%) and Qube Holdings (5.98%).

Lazard’s major holdings were Alumina (8.72%), Woodside Petroleum (8.25%), AMP (8.19%), QBE (8.08%) and Computershare (7.5%), they also had holdings in Coles (5.39%).

In its September 2019 factsheet, Lazard noted AMP and Clydesdale Bank (CYB) were two of the major contributors to underperformance in the last quarter.

AMP, Whitehaven Coal, Alumina, AMP and CYB were recurring detractors during their quarterly reports for the last year.

Top five worst performing Australian Equity funds v sector year to 31 October 2019

Recommended for you

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.

Philanthropic investment group Future Generation’s CEO, Caroline Gurney, will step down from her role at the start of next year.

The newly combined L1 Group is expectant of stabilising Platinum’s falling funds under management within the next 18 months, unveiling four growth pathways and a $330 million equity raise.

Janus Henderson Investors has launched a global small-cap fund for Australian investors, which includes a 5.4 per cent weighting to Australian equities.