Tightening credit determines stock preferences

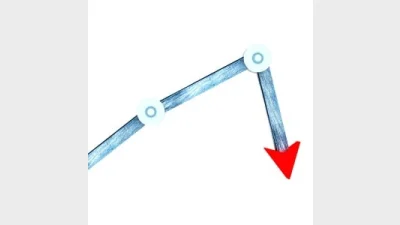

Reduction in credit growth has influenced the current positioning of the Australian equity funds which includes being underweight bond proxies and higher price-earnings stocks, DNR Capital said.

According to DNR Capital chief investment officer, Jamie Nicol there could be little doubt that when looking at a period of reduction in credit growth and that this would have a headwind effect for consumers.

“It seems most likely that this will have some incremental flow-on effect on the housing sector and consumer behaviour,” he said.

At the same time, the bigger risk would be if the reduction in credit availability snowballed into a fully blown credit crunch.

The banking and financial services Royal Commission turned the spotlight on the banks’ responsible lending obligations, Nicol stressed.

“In this environment our suite of Australian equities portfolios – ‘High Conviction’, ‘Socially Responsible’ and ‘Income’ will be managed in accordance with a number of key considerations,” he said.

“Given the inflation outlook DNR Capital’s Australian funds are underweight bond proxies and we are reducing exposure to higher price-earnings (PE) ratio stocks. With regard to elevated household debt to GDP we are underweight consumer stocks and banks.

“We are maintaining exposure to companies invested in mining and infrastructure spending, noting corporate debt is low and capex is rising.”

In terms of specific stocks, the firm said it was building positions in names like Woolworths Group (ASX: WOW), and found opportunities in companies like CYBG (ASX: CYB) and companies whose balance sheets and outlooks improved substantially, like Woodside Petroleum (ASX:WPL).

Recommended for you

Schroders has appointed a new chief executive as Simon Doyle steps down from the asset manager after 22 years.

Distribution of private credit funds through advised channels to retail investors will be an ASIC priority for 2026 as it releases the results of its thematic fund surveillance and guidance for research houses.

State Street Investment Management has taken a minority stake in private market secondaries manager Coller Capital with the pair set to collaborate on broaden each firm’s reach and drive innovation.

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.