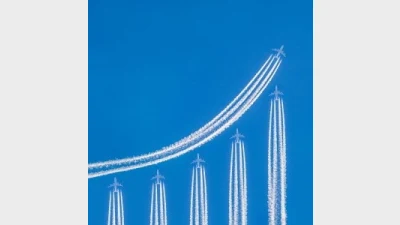

IPO Wealth surges to $75m in investments

IPO Wealth announced it surged to $75 million in investments in capital raised for its IPO Wealth Fund, as investors seek proven cash alternatives.

The firm said that volatility of the Australian stock market, coupled with property market uncertainty saw investors focusing on income-producing cash alternatives and, as a result, more than $60 million has flowed into the fund in 2018.

James Mawhinney, managing director of Mayfair 101, which is also an owner of IPO Wealth, said that investors wanted to decrease their exposure to the Australian property market and volatility of the Australian Securities Exchange (ASX).

“IPO Wealth is one of those options, and we are delighted to be able to provide investors with the opportunity to earn consistent monthly returns,” he said.

Mayfair 101 also announced plans to set up a similar fund in the UK, which would be managed by M12 Global, and would allow the group to access a larger pool of capital at a lower cost due to the low interest environment in the UK and Europe.

The company appointed Morgan Stanley’s executive Charles Grant as M12 Global’s chief executive to head up the European structure, it said.

Recommended for you

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.

Investment manager Salter Brothers has partnered with private equity firm Kilara Capital to launch an Australian sustainable investment platform focusing on decarbonisation.

Fresh off launching three active ETFs to the Australian market, Avantis Investors is already planning to expand its range with two further products next year.

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.