Avenir Capital backs Chinese consumer

The Avenir Global fund has increased its exposure to the Chinese consumer via a position in travel company TravelSky despite it being a detractor from recent performance, as it remains ‘excited’ about the long-term potential for the company.

The $32m fund targeted businesses which were competitively entrenched at a significant discount to intrinsic value and said Travelsky was a Hong Kong-listed provider of IT services to airports, airlines and travel agencies in China.

Avenir said the appeal of the company was the growing middle class in China and the increased spending on flights and travel by the Chinese consumer. It said China was also significantly investing in its airport infrastructure.

Having first invested in TravelSky in 2018, Avenir said the US/China trade war tensions had opened up an opportunity for further investment.

“We first built a position in TravelSky in late 2018 upon a pullback in the share price as the company disappointed on growth in a mobile app some investors were pinning hopes to.

“We added to our position recently when stock was caught up in trade-war tensions as well as announcing disappointing earnings driven, partly, by what we think is transitory weakness in the Chinese economy, which has resulted in air travel growth slowing to about 3-4 per cent, rather than the >10 per cent seen over the longer term.”

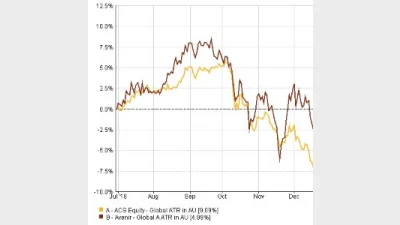

The Avenir Global fund has returned 4.9 per cent over one year to 30 June 2019 versus returns by the ACS Equity Global sector of nine per cent, according to FE Analytics. The manager said TravelSky had been a detractor in the last quarter when it lost 2.1 per cent during the three months to 30 June versus sector returns of 4.6 per cent.

Nevertheless, the firm said it remained excited about the long-term opportunity in the company as it had a ‘monopoly-like position’ in its space, was unlikely to be disrupted by new entrants and generated attractive returns on capital.

Avenir Global fund versus ACS Equity-Global over one year to 30 June.

Recommended for you

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.

Financial advisers have expressed concern about the impact including private market exposure is having on their tracking error budget, according to MSCI.

State Street will restrict its membership of global climate alliance Net Zero Asset Managers after the organisation dropped its flagship 2050 goals amid ESG backlash from the US.

Betashares has launched a global shares and a global infrastructure ETF as part of the firm’s strategic expansion strategy to support financial advisers in building more diversified portfolios.