Will Govt’s post-retirement fact sheets erode advice?

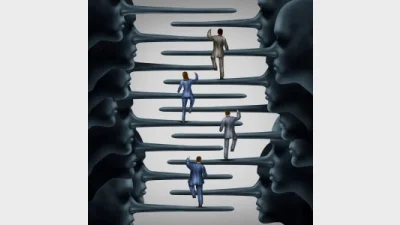

In a move likely to impact financial advisers, the Federal Government has released a consultation paper on Retirement Income Disclosure which it said was aimed at helping consumers maintain an appropriate standard of living in retirement.

However, the Government’s consultation documents argue that the provision of standard metrics would not constitute financial advice and that it wants to exempt such arrangements from the advice framework.

“Clarity regarding the interactions with advice will be addressed as part of the regulatory framework of the retirement income framework,” it said. “At this stage, the preferred option is for the fact sheet to be exempted from the advice framework, similar to the current treatment of [product disclosure statements] PDSs.

The paper proposes a range metrics to help consumers assess a particular retirement income product aligns with their own preferences in relation to potential income, flexibility and risk management with the data being delivered by way of fact sheets.

Launching the consultation period, Assistant Treasurer, Stuart Robert said the factsheets would cut through to the key features that mattered when people were making retirement income decision.

According to the consultation paper, the approach being proposed by the Government is premised on average real income from a $100,000 investment over the period from retirement (currently age 67) to age 97 with the income being net of fees and taxes and presented as a fact sheet graphic.

It suggests that a range of options could be considered for presenting income, but that “describing expected retirement income as ‘take home pay’ from the product may make the concepts more user friendly for consumers”.

Recommended for you

Financial advisers will have to pay around $10.4 million of the impending $47.3 million CSLR special levy but Treasury has expanded the remit to also include super fund trustees and other retail-facing sub-sectors.

Recommendations by the FSC around implementing a practicing certificate framework for advisers would be burdensome and add little value for AFSLs, according to SIAA.

The RBA has made its latest interest rate decision at the the final monetary policy meeting of 2025.

AZ NGA has acquired Sydney-based advice and wealth management firm Financial Decisions, allowing its CEO to step back and focus on providing advice.