Vertically-integrated instos skewing FSC: ClearView

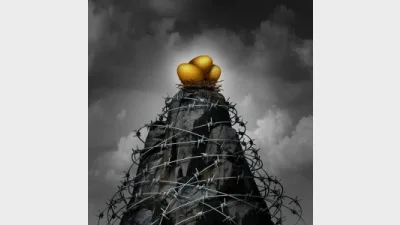

The dominance of large vertically integrated institutions within the Financial Services Council (FSC) means the organisation cannot deliver pro-consumer and pro-competition outcomes with respect to insurance approved product lists (APLs), according to one of the FSC's own member companies, ClearView Wealth.

In a hard-hitting submission filed with the Joint Parliamentary Committee on Corporations and Financial Services, ClearView claimed the Government and the Australian Securities and Investments Commission (ASIC) had effectively granted the FSC the right to legislate by the APL Standard and to deal with monitoring and enforcement of the APL Standard through the FSC's self-regulatory role.

It said that this position was consistent with the FSC's position with respect to the development of a Life Code of Conduct.

"While ClearView is currently a member of FSC, we have reluctantly reached the view that the pro-consumer, pro-competition outcomes sought by the Government will not be achieved if the FSC is permitted to continue its current course in developing its APL standard," the ClearView submission said.

"This assessment results from the dominant position taken within the FSC by large, vertically-integrated institutions who have no motivation to agree to a standard that would remove or even reduce current anti-competitive practices or that would promote competition, innovation or greater choice for advisers and consumers," it said.

Elsewhere in its submission, ClearView pointed to the insurance APLs of major vertically-integrated institutions as being populated by in-house products noting that such narrow APLs were designed to influence advice recommendations and channel clients into those in-house products.

"Any process in place to recommend products not included on the APL is typically cumbersome and dissuasive," the submission said. "The institutions make money from the widespread distribution (sale) of their products by aligned advisers."

Recommended for you

The Reserve Bank of Australia (RBA) has lowered rates to a level not seen since mid-2023.

Financial Services Minister Stephen Jones has shared further details on the second tranche of the Delivering Better Financial Outcomes reforms including modernising best interests duty and reforming Statements of Advice.

The Federal Court has found a company director guilty of operating unregistered managed investment schemes and carrying on a financial services business without holding an AFSL.

The Governance Institute has said ASIC’s governance arrangements are no longer “fit for purpose” in a time when financial markets are quickly innovating and cyber crime becomes a threat.