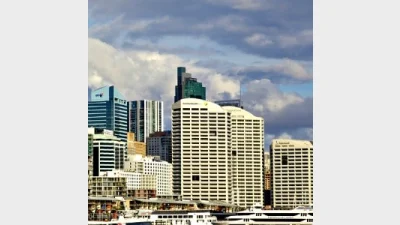

Will commercial offices bounce back?

Commercial office vacancy rates should drop sharply in the next two years as Australia emerges from COVID lockdowns due to high vaccination rates, increasing employment and a decline in the popularity of work from home, according to AMP Capital research.

The AMP Capital Wholesale Office Fund (AWOF) has over $7 billion in core office assets, providing investors with exposure to an office portfolio exclusively located in the markets of Sydney and Melbourne.

AMP Capital’s research found that although Australia’s strong economic recovery was interrupted by lockdowns across the country, causing a short-term pain, the economic momentum following the re-opening could bode well for commercial real estate and investors would be able to find value from both traditional and alternative real estate sectors.

However, the completion of a number of office developments in Sydney and Melbourne was likely to see vacancy levels increase during the course of this year, with a number of larger projects potentially coming on to the market over the short-term.

At the same time, following the market correction last year, medium-term supply risks significantly reduced as several new projects were scaled back, put on hold or were withdrawn altogether.

“Overall our estimate for additional supply from 2021 to 2025 has already reduced by over 50% compared to our pre-COVID forecast, with moderate supply levels to further support an office market recovery over the coming years,” AMP Capital said.

According to its head of real estate, Kylie O’Connor, Perth provided a good snapshot of how the market rebounded, as it represented a small number of cities globally with a sizeable office market where over a prolonged period of time there were only limited or no government restrictions in place and workers were free to return to the office in May last year.

“While it was slow going at first, as office workers returned to the CBD following the first lockdown, physical office occupancy steadily increased to 77% by October 2020, according to the Property Council of Australia, just 6.5% below the last pre-COVID reading in January 2020 of 83.5%,” O’Connor said.

“Many pieces are coming together for the outlook in 2022, which is set to mark a turning point for the office market. As the vaccination rollout progresses and the risk of further lockdowns should recede, expectations are for office workers to return to the CBD in steadily growing numbers.

"We are forecasting that net absorption in the Sydney CBD market will improve strongly in 2022, supported by higher base demand as COVID lockdowns ease, and high levels of pre-existing commitments to new developments.”

Recommended for you

Evidentia’s chief investment strategist Nathan Lim has announced his retirement after a 30-year career.

GQG Partners has marked its fifth consecutive month of outflows as its AI concerns lead to fund underperformance but overall funds under management increased to US$166.1 billion.

Apostle Funds Management is actively pursuing further partnerships in Asia and Europe but finding a suitable manager is a “needle in a haystack”.

Managed account provider Trellia Wealth Partners, formed from the merger between Betashares and InvestSense, has appointed its first managing partner.