Western Asset Aus Bond Fund hits $1bn

Legg Mason has announced that its actively-managed Western Asset Australian Bond Fund has passed $1 billion in funds under management.

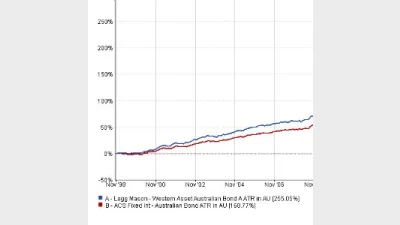

The fund, which was designed to invest in Australian dollar-denominated debt securities paying fixed or floating rate coupons issued by governments, supernational bodies and Australian and foreign corporates, outperformed the Bloomberg AusBond Composite 0+ Year index and was ranked top quartile in its peer groups over three, five and 10 years, the firm said.

Anthony Kirkham, head of investment management and Australian operations at Western Asset, said the fund favoured higher quality assets and currently had an average ‘AA’ credit rating.

“With equity market volatility increasing, as well as broader concerns around global growth and political outcomes, the defensive qualities of a well-constructed bond fund can add much needed diversification and protection to an overall portfolio,” he added.

A listed version of the Fund was launched in November 2018 as Australia’s first fixed income Active ETF – the BetaShares Legg Mason Australian Bond Fund (BNDS).

Recommended for you

Nuveen has made its private real estate strategy available to Australian wholesale investors, democratising access to a typically institutional asset class.

VanEck is expanding its fixed income range with a new ETF this week to complement its existing subordinated debt strategy which has received $1 billion in inflows this year.

Specialist global equities manager Nanuk has celebrated 10 years of its flagship New World Fund and is actively considering its next possible vehicle.

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.