RARE’s fund sees strong start to the year

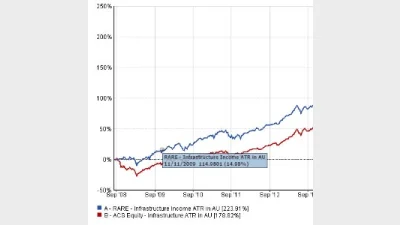

RARE Infrastructure has reported a strong start to the year for its Income Fund, which saw a return of 14.7 per cent for the three months to the end of March, net of fees.

At the same time, the fund’s benchmark, the OECD G7 Inflation Index plus 5.5 per cent, was up 7.2 per cent over the 12 months and the S&P Global Infrastructure Index was up 16.8 per cent over the same period.

RARE’s senior investment analyst and portfolio manager, Shane Hurst, attributed the fund’s success to the fact that infrastructure offered lower volatility, stable cash flow, inflation protection and diversification.

“Infrastructure companies provide predictable income distributions due to stable earnings derived from the underlying asset. Regulation and/or long-term contracts provide stable cash flow and greater capital stability,” he said.

The fund also initiated positions in several companies during the quarter, which included Portuguese electricity company Energias de Portugal, airport operator Sydney Airport, Chinese toll road operator Shenzhen Expressway, and a US electric company Clearway Energy.

Domestically, its big holdings included Transurban and Spark Infrastructure.

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.