Lockdown rules hit retail share prices

The lockdown rules are causing a ‘dramatic reduction’ in retail traffic with major retailers reporting declining share prices despite earlier strong sales growth for some as shoppers stockpiled items.

Many companies had chosen to close their businesses if they did not provide an ‘essential service’ including Premier Investments which owned brands such as Peter Alexander, Just Jeans and Smiggle.

According to the Australian Bureau of Statistics, retail was Australia’s second-largest employer behind healthcare with many employees being young or temporary workers.

The stricter laws followed earlier ‘panic buying’ by consumers as they prepared for a lockdown which boosted sales at department stores such as Officeworks and Harvey Norman.

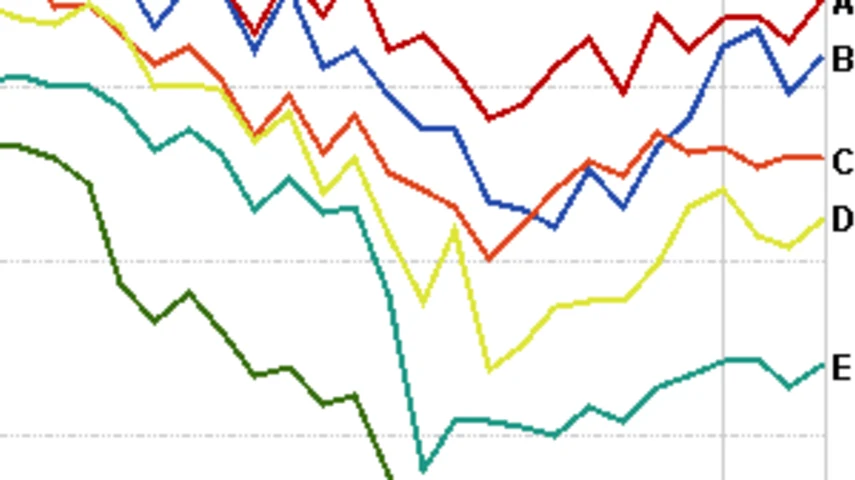

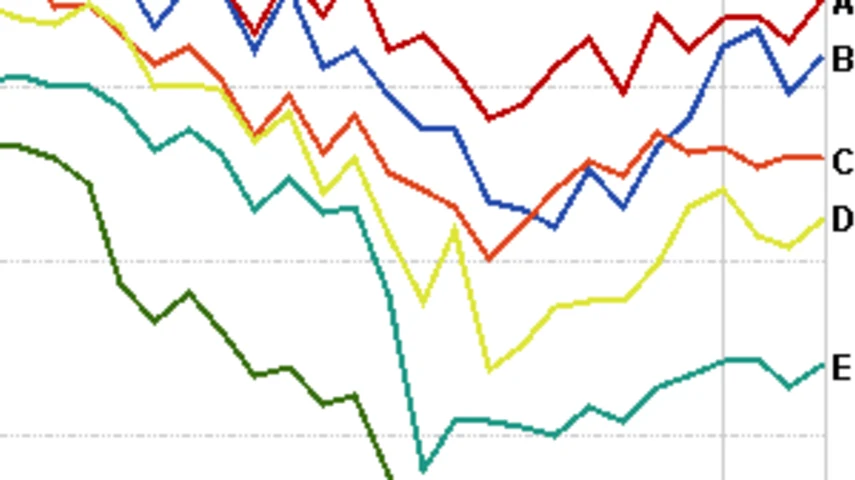

Looking at share prices since the start of 2020, badly-affected firms included department store Myer which was down 70% and Super Retail Group, down 56%, which owns stores such as Macpac and Rebel Sport.

Share price performance of Wesfarmers, JB HI-FI, Harvey Norman, Premier Investments, Super Retail Group and Myer versus ASX 200 since the start of 2020 to 06 April, 2020.

Scott Haslem, chief investment officer at Crestone Wealth Management, said: “A large swathe of Australian retailers- most of which function on relatively tight margins-have shut their doors with the intention of hibernating through this period.

“While lockdowns clearly have an extremely negative initial effect on economic activity, there appears to be an inverse relationship between the severity and duration… investors and economic agents fully recognise that a recession is occurring because of the deliberate actions of policymakers.

“Thus, they may be less inclined to extrapolate meaning that demand may recover faster than usual once activity resumes.”

However, unsurprisingly, it was a different share price story for supermarkets which were one of the few sectors to remain open.

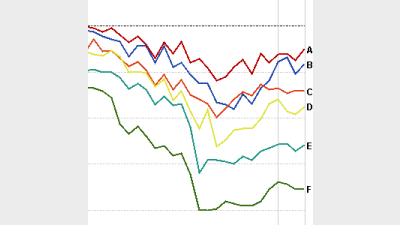

Coles, Woolworths and MetCash, which owns the IGA convenience store brand, all reported gains since the start of the year.

The best gains were seen by MetCash and Coles which both reported gains of more than 10%.

Share price performance of MetCash, Coles and Woolworths versus ASX 200 since the start of 2020 to 06 April, 2020.

Recommended for you

A growing trend of factor investing in ETFs has seen the rise of smart beta or factor ETFs, but Stockspot has warned that these funds likely won’t deliver as expected and could cost investors more long-term.

ASIC has released a new regulatory guide for exchange-traded products (ETPs), including ETFs, on the back of significant growth in the market.

Assets in Macquarie Asset Management’s active ETFs have tripled to $2 billion in the last six months, helping the division deliver a net profit contribution of $1.1 billion.

With property becoming increasingly out of reach for young Australia, Vanguard has proposed a tax-incentivised scheme to help cash-heavy individuals build wealth.